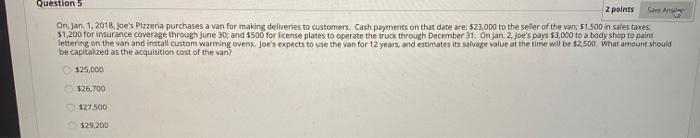

Question: help Question 5 2 points On Jan 1, 2018. Joe's Plazeria purchases a van for making deliveries to customers. Cash payments on that date are:

Question 5 2 points On Jan 1, 2018. Joe's Plazeria purchases a van for making deliveries to customers. Cash payments on that date are: 523,000 to the seller of the van 51,500 in sales taxes, $1,200 for insurance coverage through June 30, and $500 for license plates to operate the truck through December 31. On jan 2. Joe's pays $3.000 to a body shop to paint lettering on the van and install custom warming ovens Joe's expects to use the van for 12 years, and estimates its salvage value at the time will be $2,500. What amount should be capitalized as the acquisition cost of the van? 525,000 $26.700 127.500 529,200

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts