Question: Help Question 5. Omega plc is considering a new three-year expansion project that requires an initial nem current asset investment of 3.9 million. The non-current

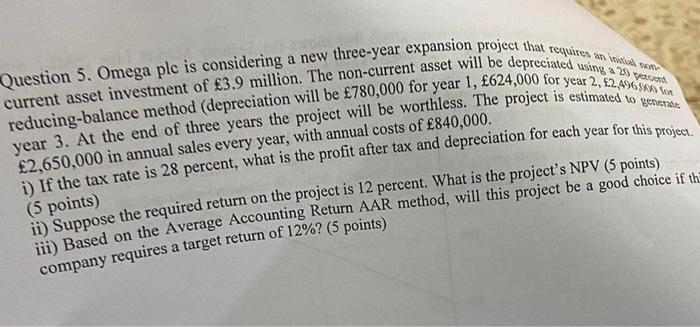

Question 5. Omega plc is considering a new three-year expansion project that requires an initial nem current asset investment of 3.9 million. The non-current asset will be depreciated asing 220 be 780,000 for year 1,624,000 for year 2,2,496,000 for reducing-balance method (depreciation will be 780,000 for year 1 , The project is estimated to generate year 3. At the end of three years the project will be worthless. 840,000. 2,650,000 in annual sales every year, with annual costs and depreciation for each year for this project. i) If the tax rate is 28 percent, what is the profit aficect's NPV ( 5 points) (5 points) ii) Suppose the required return on the project is 12 percent. What is the prod, will this project be a good choice if th iii) Based on the Average Accounting Retur (5 A.ints)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts