Question: help quickly please Instruction: Complete ALL questions from this section. The audited accounts of Possibility Limited at December 31, 2021, shows a profit of $4,200,000

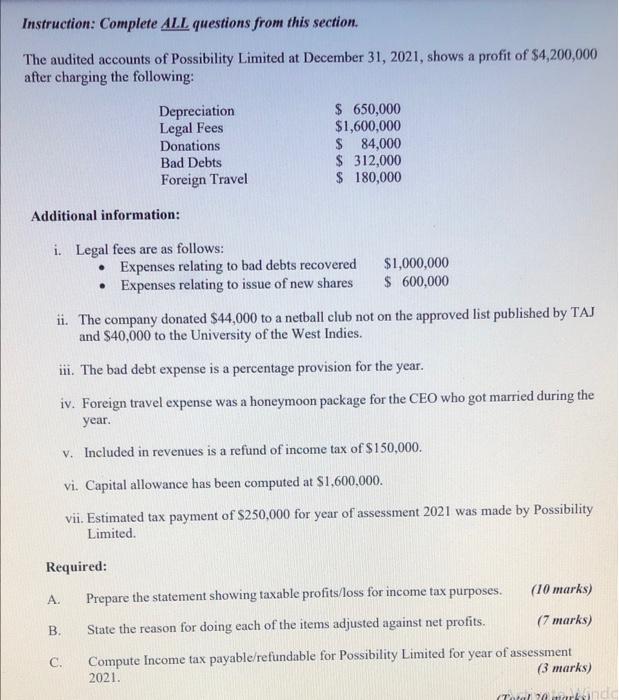

Instruction: Complete ALL questions from this section. The audited accounts of Possibility Limited at December 31, 2021, shows a profit of $4,200,000 after charging the following: Additional information: ii. The company donated $44,000 to a netball club not on the approved list published by TAJ and $40,000 to the University of the West Indies. iii. The bad debt expense is a percentage provision for the year. iv. Foreign travel expense was a honeymoon package for the CEO who got married during the year. v. Included in revenues is a refund of income tax of $150,000. vi. Capital allowance has been computed at $1,600,000. vii. Estimated tax payment of $250,000 for year of assessment 2021 was made by Possibility Limited. Required: A. Prepare the statement showing taxable profits/loss for income tax purposes. (10 marks) (7 marks) B. State the reason for doing each of the items adjusted against net profits. C. Compute Income tax payable/refundable for Possibility Limited for year of assessment 2021. (3 marks) Instruction: Complete ALL questions from this section. The audited accounts of Possibility Limited at December 31, 2021, shows a profit of $4,200,000 after charging the following: Additional information: ii. The company donated $44,000 to a netball club not on the approved list published by TAJ and $40,000 to the University of the West Indies. iii. The bad debt expense is a percentage provision for the year. iv. Foreign travel expense was a honeymoon package for the CEO who got married during the year. v. Included in revenues is a refund of income tax of $150,000. vi. Capital allowance has been computed at $1,600,000. vii. Estimated tax payment of $250,000 for year of assessment 2021 was made by Possibility Limited. Required: A. Prepare the statement showing taxable profits/loss for income tax purposes. (10 marks) (7 marks) B. State the reason for doing each of the items adjusted against net profits. C. Compute Income tax payable/refundable for Possibility Limited for year of assessment 2021

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts