Question: Help requested, thank you! Questions with text cut off are are below. 2. - Determine (a) the unit variable cost and (b) the unit contribution

Help requested, thank you!

Questions with text cut off are are below.

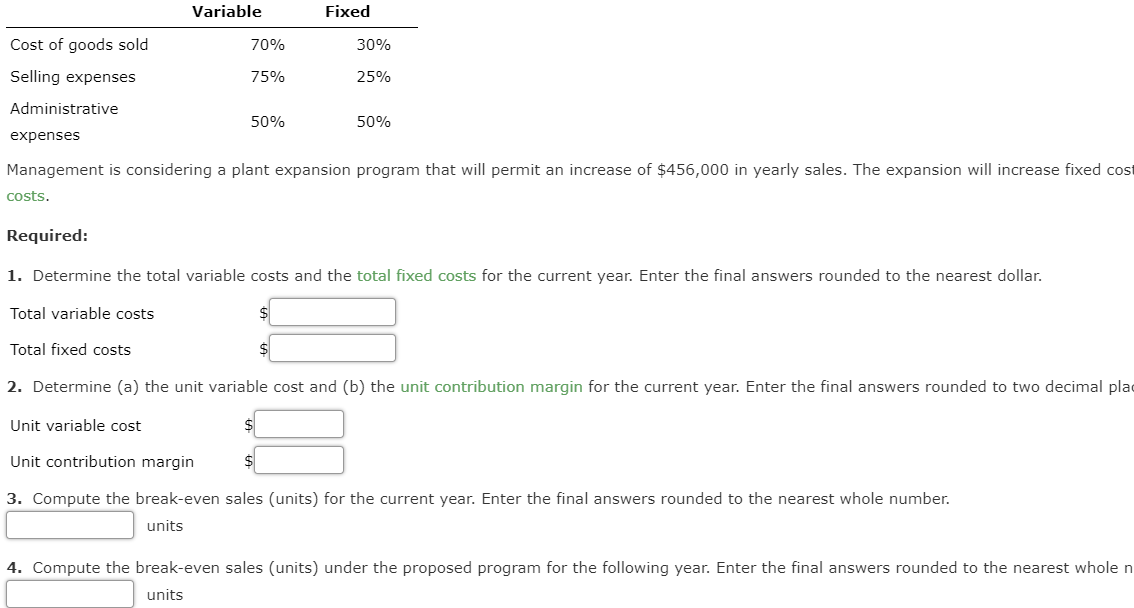

2. - Determine (a) the unit variable cost and (b) the unit contribution margin for the current year. Enter the final answers rounded to two decimal places.

4. - Compute the break-even sales (units) under the proposed program for the following year. Enter the final answers rounded to the nearest whole number.

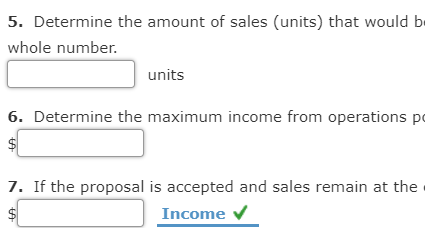

Questions with text cut off are are below.

5. - Determine the amount of sales (units) that would be necessary under the proposed program to realize the $67,450 of income from operations that was earned in the current year. Enter the final answers rounded to the nearest whole number.

6. - Determine the maximum income from operations possible with the expanded plant. Enter the final answer rounded to the nearest dollar.

7. - If the proposal is accepted and sales remain at the current level, what will the income or loss from operations be for the following year? Enter the final answer rounded to the nearest dollar.

-

Regarding the comment left here about missing information. This is the only information that is provided to me and available to work with. The only other thing I can provide is the how to solve portion of the question, that is included below.

-

The problem provides us with information related to the present and proposed conditions of Bolen Company [phonetic]. Using this information, we are asked to solve the various requirements shown here. Let's first determine the total variable costs and the total fixed costs for Year 1. The total cost includes the cost of goods sold, selling expenses, and administrative expenses. The total cost of goods sold for Year 1 is $6,200,000, of which 60% is variable. Thus, the variable portion of the cost of goods sold is $3,720,000. The total selling expenses for Year 1 are $3,400,000, of which 75% is variable. Thus, the variable selling expenses are $2,550,000. Similarly, the total administrative expenses for Year 1 are $1,550,000, of which 60% is variable. Therefore, the variable administrative expenses are $930,000. Now, we can determine the fixed costs by subtracting the variable costs from the total costs. By deducting $3,720,000 of variable costs from the total cost of goods sold of $6,200,000, we determine the fixed cost of goods sold is $2,480,000. By deducting $2,550,000 of variable selling expenses from the total selling expenses of $3,400,000, we determine the fixed selling expenses are $850,000. Similarly, by deducting $930,000 from $1,550,000, we determine the fixed administrative expenses are $620,000. By adding all 3 costs, we determine the total variable costs to be $7,200,000, and the total fixed costs to be $3,950,000. Next, we determine a unit variable cost and the unit contribution margin. During the year, Bolen sales were $16,800,000 as the company sold 120,000 units at $140 each. We determined the total variable costs as $7,200,000. By dividing the total variable costs by 120,000 units, we determined the unit variable cost is $60. Remember that the unit contribution margin is the difference between the unit sales price and the unit variable cost. Thus, by subtracting $60 from $140, we determine the unit contribution margin to be $80. Next, we will determine the break-even sales units under the present condition and the proposed program. Remember that a break-even point is the level of operations where revenue is equal to the costs incurred in an organization. So at a break-even point, a company has neither a profit nor a loss. The break-even sales units are computed by dividing the fixed costs by the unit contribution margin. The total fixed cost for Year 1 are $3,950,000, and we determine the unit contribution margin is $80. Thus, by dividing $3,950,000 by $80, we arrive at the break-even sales of 49,375 units for Year 1. The proposed program increases the total fixed costs by $1,250,000. Thus, by dividing the sum of $3,950,000 plus $1,250,000 by the unit contribution margin of $80, we determine the break-even sales in units for the proposed program are 65,000 units. Next, we compute the required units to be sold under the proposed program to realize an income from operations, or target profit of $5,650,000. The required sales to achieve a target profit are computed by dividing the sum of the fixed costs and the target profit by the unit contribution margin. Thus, by adding the fixed costs of $5,200,000 and the target profit of $5,650,000, then dividing the resulting amount by the unit contribution margin of $80, we determine that 135,625 units should be sold to realize the target profit of $5,650,000. Let's now determine the maximum possible income from the expanded plant. After expansion, sales amount to $19,600,000, which is the sum of the existing sales of $16,800,000, plus an increase in yearly sales of $2,800,000. By dividing the new total sales of $19,600,000 by the sales price of $140, we determine the number of units sold is 140,000 units. Thus, the total variable costs are calculated by multiplying 140,000 units by $60 per unit, which equals $8,400,000. By subtracting $8,400,000 from the sales of $19,600,000, we determine the contribution margin is $11,200,000. As we calculated earlier, the new plant incurs fixed costs of $5,200,000, which is the sum of the current fixed costs of $3,950,000 and the increase of $1,250,000. By subtracting the fixed cost from the contribution margin, we determine the income from operations after the expansion program to be $6,000,000. Finally, we determine the income from operations when the proposal is accepted with the same sales level. The present operating income is $5,650,000. The only additional cost is the fixed costs of $1,250,000. By deducting the additional cost from the present operating income, we determine the income from operations to be $4,400,000.

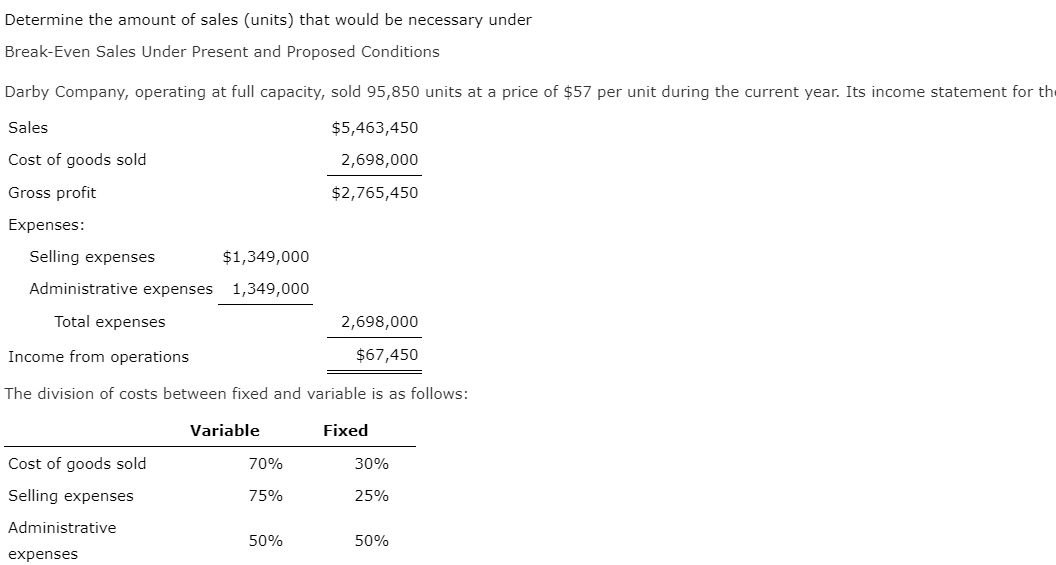

Determine the amount of sales (units) that would be necessary under Break-Even Sales Under Present and Proposed Conditions Darby Company, operating at full capacity, sold 95,850 units at a price of $57 per unit during the current year. Its income statement for th Sales $5,463,450 2,698,000 $2,765,450 Cost of goods sold Gross profit Expenses: Selling expenses $1,349,000 Administrative expenses 1,349,000 Total expenses 2,698,000 Income from operations $67,450 The division of costs between fixed and variable is as follows: Variable Fixed Cost of goods sold 70% 30% Selling expenses 75% 25% Administrative 50% 50% expenses Variable Fixed Cost of goods sold 70% 30% Selling expenses 75% 25% Administrative 50% 50% expenses Management is considering a plant expansion program that will permit an increase of $456,000 in yearly sales. The expansion will increase fixed cosi costs. Required: 1. Determine the total variable costs and the total fixed costs for the current year. Enter the final answers rounded to the nearest dollar. Total variable costs Total fixed costs 2. Determine (a) the unit variable cost and (b) the unit contribution margin for the current year. Enter the final answers rounded to two decimal pla Unit variable cost Unit contribution margin 3. Compute the break-even sales (units) for the current year. Enter the final answers rounded to the nearest whole number. units 4. Compute the break-even sales (units) under the proposed program for the following year. Enter the final answers rounded to the nearest whole n units 5. Determine the amount of sales (units) that would be whole number. units 6. Determine the maximum income from operations po $ 1. If the proposal is accepted and sales remain at the Income $

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts