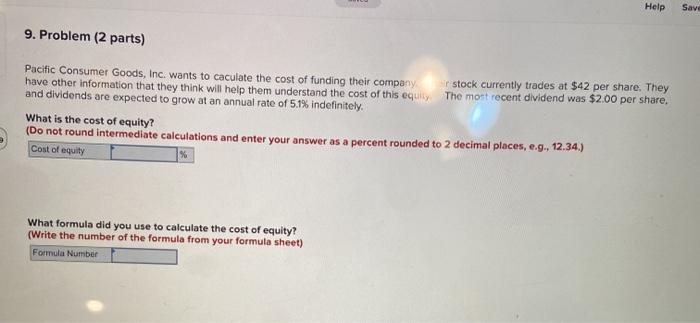

Question: Help Save 9. Problem (2 parts) Pacific Consumer Goods, Inc. wants to caculate the cost of funding their company in stock currently trades at $42

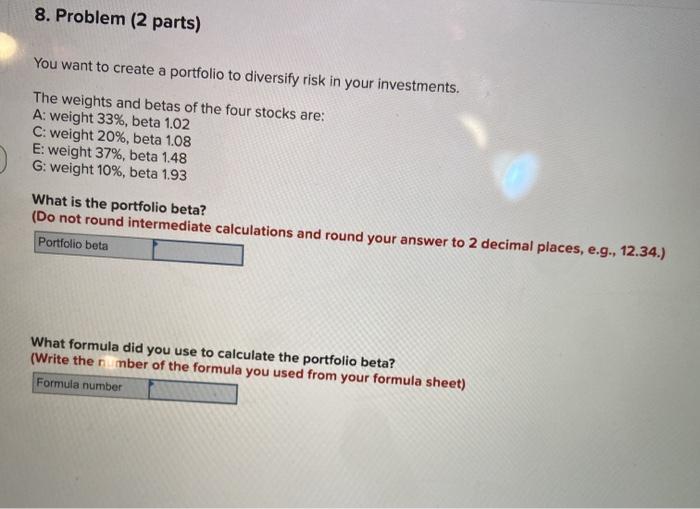

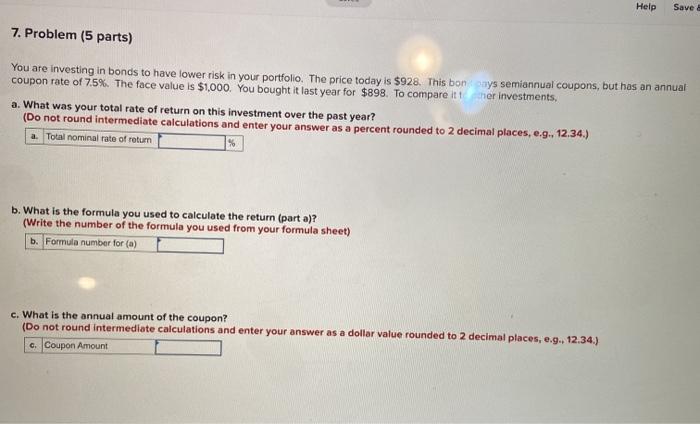

Help Save 9. Problem (2 parts) Pacific Consumer Goods, Inc. wants to caculate the cost of funding their company in stock currently trades at $42 per share. They have other information that they think will help them understand the cost of this equity. The most recent dividend was $2.00 per share, and dividends are expected to grow at an annual rate of 5.1% indefinitely What is the cost of equity? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 12.34.) Cost of equity What formula did you use to calculate the cost of equity? (Write the number of the formula from your formula sheet) Formula Number 8. Problem (2 parts) You want to create a portfolio to diversify risk in your investments. The weights and betas of the four stocks are: A: weight 33%, beta 1.02 C: weight 20%, beta 1.08 E: weight 37%, beta 1.48 G: weight 10%, beta 1.93 What is the portfolio beta? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 12.34.) Portfolio beta What formula did you use to calculate the portfolio beta? (Write thember of the formula you used from your formula sheet) Formula number Help Save 7. Problem (5 parts) You are investing in bonds to have lower risk in your portfolio. The price today is $928. This bonnys semiannual coupons, but has an annual coupon rate of 7.5%. The face value is $1000. You bought it last year for $898. To compare itt mer investments, a. What was your total rate of return on this investment over the past year? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.... 12.34.) a. Total nominal rate of return % b. What is the formula you used to calculate the return (part a)? (Write the number of the formula you used from your formula sheet) b. Formula number for (a) c. What is the annual amount of the coupon? (Do not round Intermediate calculations and enter your answer as a dollar value rounded to 2 decimal places, e.9., 12.34.) c. Coupon Amount

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts