Question: Help Save & 9. Problem (6 parts) You examine the stock of Campus Brewery which is estimated to pay dividends of $2.80 and $2.32 over

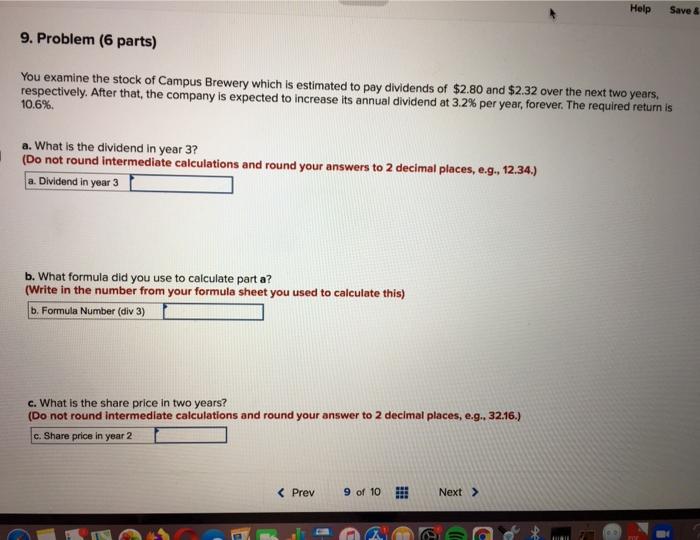

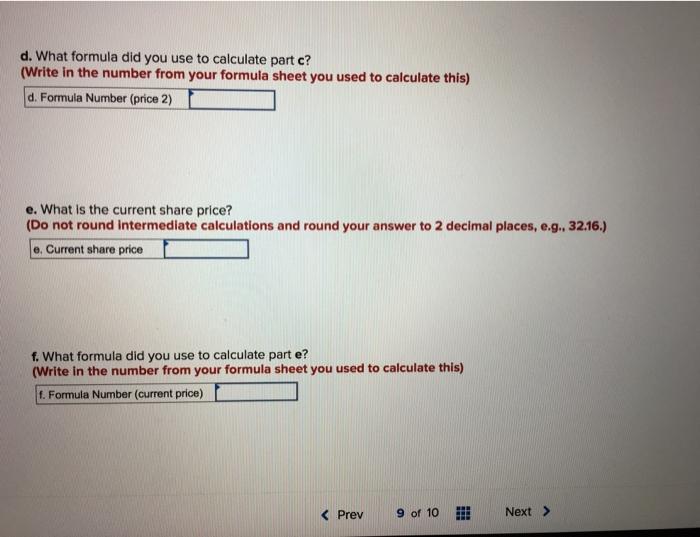

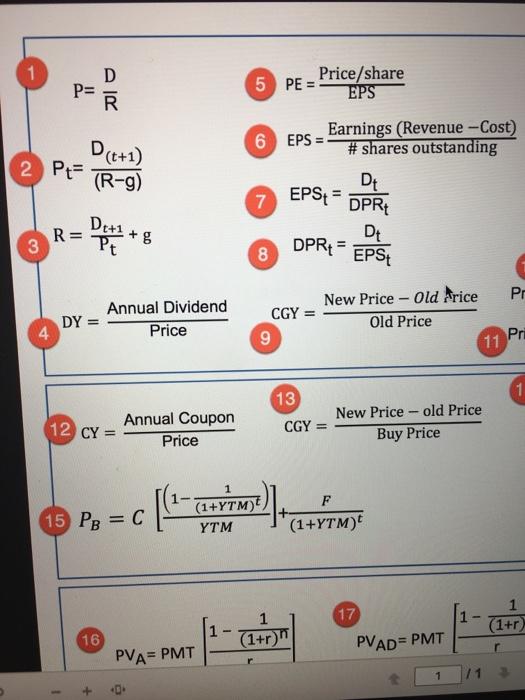

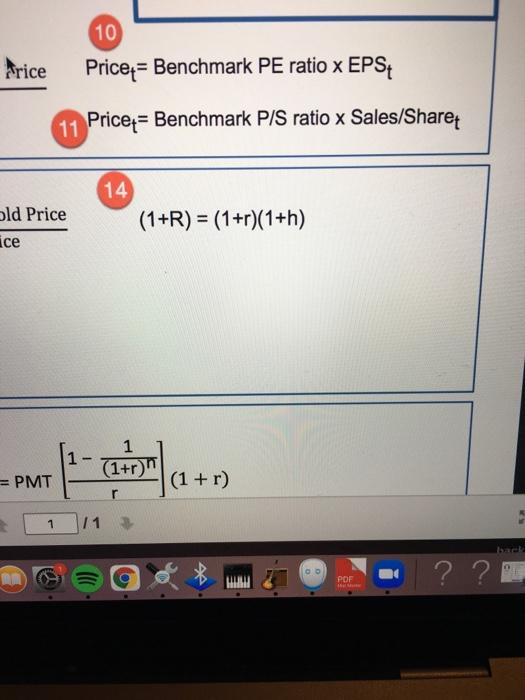

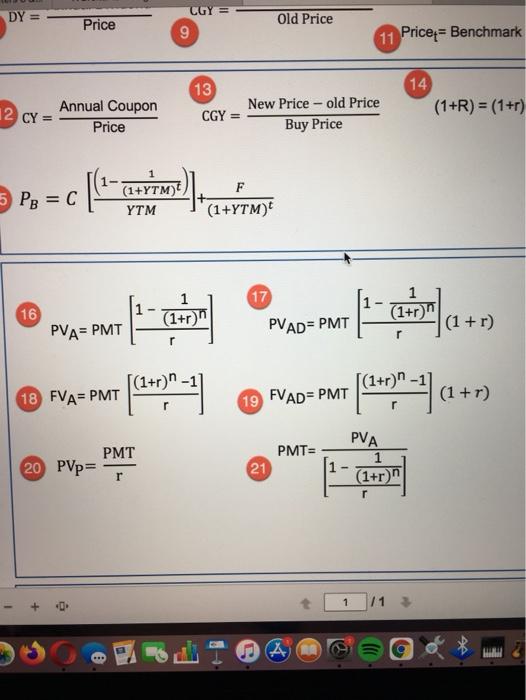

Help Save & 9. Problem (6 parts) You examine the stock of Campus Brewery which is estimated to pay dividends of $2.80 and $2.32 over the next two years, respectively. After that, the company is expected to increase its annual dividend at 3.2% per year, forever. The required return is 10.6% a. What is the dividend in year 3? (Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 12.34.) a. Dividend in year 3 b. What formula did you use to calculate part a? (Write in the number from your formula sheet you used to calculate this) b. Formula Number (div 3) c. What is the share price in two years? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g.. 32.16.) c. Share price in year 2 d. What formula did you use to calculate part c? (Write in the number from your formula sheet you used to calculate this) d. Formula Number (price 2) e. What is the current share price? (Do not round Intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) e. Current share price f. What formula did you use to calculate part e? (Write in the number from your formula sheet you used to calculate this) f. Formula Number (current price) D P= R 5 PE - Price/share D (t+1) 2 Pt= (R-g) EPS Earnings (Revenue - Cost) 6 EPS = # shares outstanding Dt 7 EPS = DPR Dt 8 DPR = EPS D[+1 R= PE + g 3 Annual Dividend DY = Price New Price - Old Price Pr CGY = Old Price 9 11 Pri 4 1 13 New Price -old Price CGY = Buy Price 12 CY Annual Coupon Price 1- 15 PB = C 1 (1+YTM) YTM (1+YTM) 17 1 1 (1+r) (1+r 16 PVAD= PMT PVA= PMT 1 10 Price Price = Benchmark PE ratio x EPS 11 Price = Benchmark P/S ratio x Sales/Sharet 14 old Price ice (1+R) = (1+r)(1+h) 1 1 (1+r)" = PMT (1 + r) r r 1 11 A OO ? ? O POF DY = Price CGY = 9 Old Price 11 Price = Benchmark 13 14 12 CY= Annual Coupon Price (1+R) = (1+r) CGY New Price - old Price Buy Price = [4- F 5 PB = C (1+YTM) YTM + (1+YTM) 1 16 1 (1+r)" 17 PVAD=PMT PVA= PMT (1+r) [(1+r)" |(1+r)" 18 FVA= PMT [(3:47) " - 19 FVAD= PMT - (1470- (1+r) PMT= PMT 20 PVp= PVA 1 (1+r) 21 1- r r 1 11 n 1)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts