Question: Help Save & E On April 1, a company provides services to one of its customers for $12,000. As payment for the services, the company

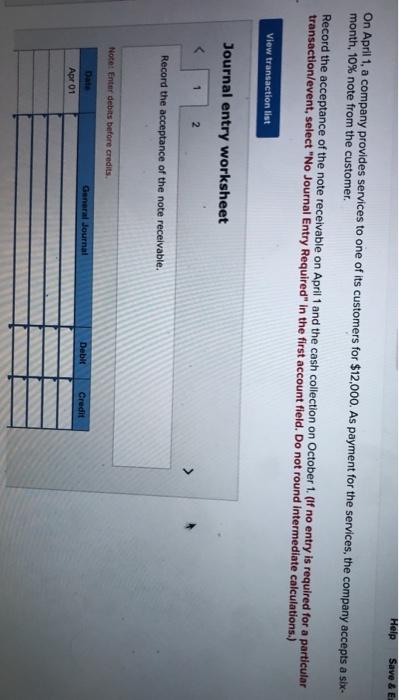

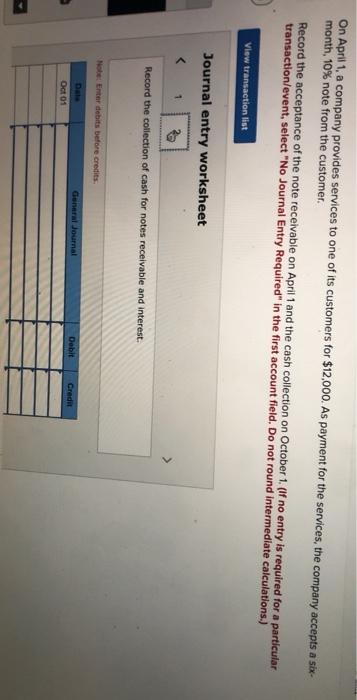

Help Save & E On April 1, a company provides services to one of its customers for $12,000. As payment for the services, the company accepts asb- month, 10% note from the customer. Record the acceptance of the note receivable on April 1 and the cash collection on October 1. (If no entry is required for a particular transaction/event, select "No Journal Entry Required" in the first account field. Do not round intermediate calculations.) View transaction that Journal entry worksheet 1 Record the acceptance of the note receivable. Note: Enter debits before credits General Journal Debit Date Apr 01 Credit On April 1, a company provides services to one of its customers for $12,000. As payment for the services, the company accepts a six- month, 10% note from the customer. Record the acceptance of the note receivable on April 1 and the cash collection on October 1. (If no entry is required for a particular transaction/event, select "No Journal Entry Required" in the first account field. Do not round intermediate calculations.) View transaction list Journal entry worksheet Record the collection of cash for notes receivable and interest Note: Enter debits before credits General Journal Debit Credit Oct 01

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts