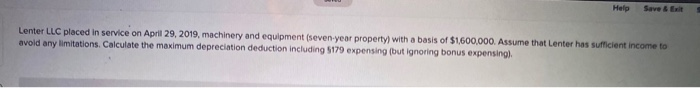

Question: Help Save & Ei Lenter LLC placed in service on April 29, 2019, machinery and equipment (seven-year property with a basis of $1,600,000. Assume that

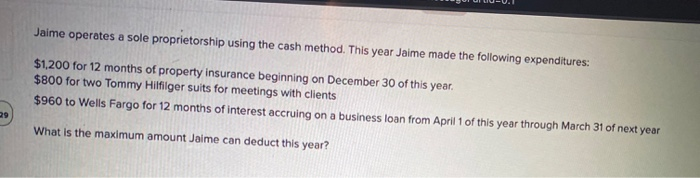

Help Save & Ei Lenter LLC placed in service on April 29, 2019, machinery and equipment (seven-year property with a basis of $1,600,000. Assume that Lenter has sufficient income to avold any limitations Calculate the maximum depreciation deduction including 5179 expensing (but ignoring bonus expensing) Jaime operates a sole proprietorship using the cash method. This year Jaime made the following expenditures: $1,200 for 12 months of property insurance beginning on December 30 of this year $800 for two Tommy Hilfiger suits for meetings with clients $960 to Wells Fargo for 12 months of interest accruing on a business loan from April 1 of this year through March 31 of next year 29 What is the maximum amount Jaime can deduct this year

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts