Question: Help Save & El Submit 2 Check my work Assume Maple Corp. has just completed the third year of its existence (year 3). The table

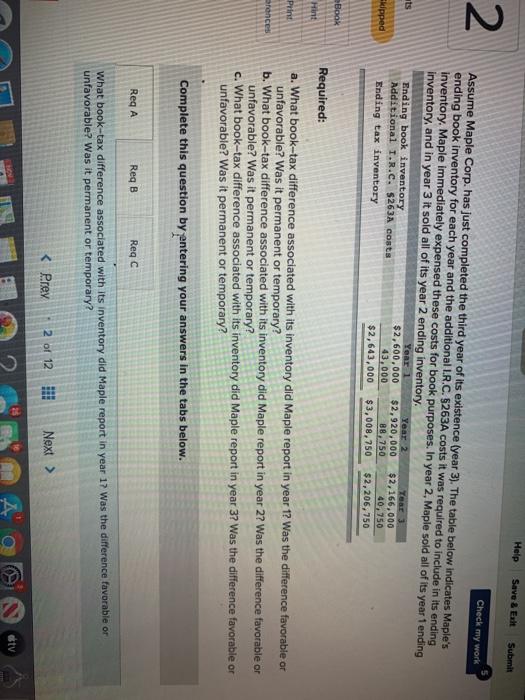

Help Save & El Submit 2 Check my work Assume Maple Corp. has just completed the third year of its existence (year 3). The table below indicates Maple's ending book inventory for each year and the additional I.R.C. 5263A costs it was required to include in its ending Inventory, Maple immediately expensed these costs for book purposes. In year 2, Maple sold all of its year ending inventory, and in year 3 it sold all of its year 2 ending inventory. Year 3 Ending book inventory $2,600,000 $2,920,000 $2,166,000 Additional I.R.C. $263A costs 43,000 88,750 40,750 Ending tax inventory $2,643,000 $3,008,750 $2,206,750 Year 1 Year 2 Ekipped Book Hint Punt Bronces Required: a. What book-tax difference associated with its inventory did Maple report in year 1? Was the difference favorable or unfavorable? Was it permanent or temporary? b. What book-tax difference associated with its inventory did Maple report in year 2? Was the difference favorable or unfavorable? Was it permanent or temporary? c. What book-tax difference associated with its inventory did Maple report in year 3? Was the difference favorable or unfavorable? Was it permanent or temporary? Complete this question by entering your answers in the tabs below. Reg A Reg B Reqc What book-tax difference associated with its inventory did Maple report in year 17 was the difference favorable or unfavorable? Was it permanent or temporary? A. stv

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts