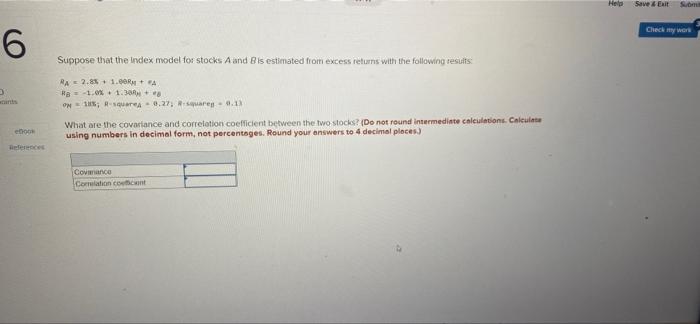

Question: Help Save Et Check my won 6 Suppose that the Index model for stocks A and Bis estimated from excess returns with the following results

Help Save Et Check my won 6 Suppose that the Index model for stocks A and Bis estimated from excess returns with the following results RA = 2.8%+ 1.GR + A B = 1.0% 1.30 OH = 1; Re-0.27Risware - 0.1% What are the covariance and correlation coefficient between the two stocks? (Do not round intermediate calculations. Calculate using numbers in decimal form, not percentages. Round your answers to 4 decimal places) 000 References Comance Correlation cont

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock