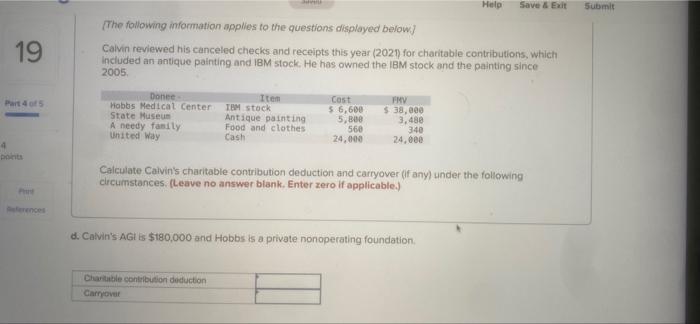

Question: Help Save & EX Submit 19 (The following information applies to the questions displayed below) Calvin reviewed his canceled checks and receipts this year (2021)

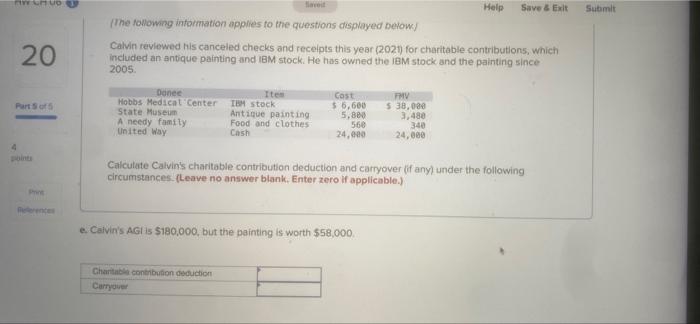

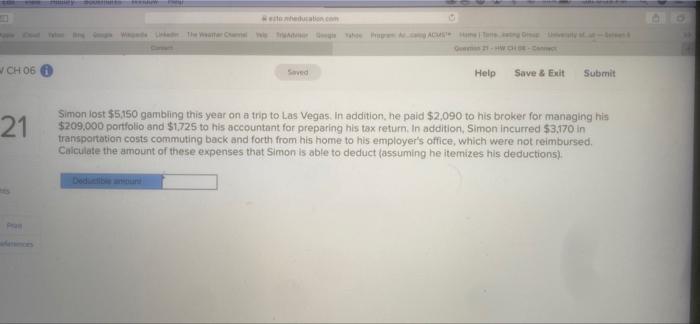

Help Save & EX Submit 19 (The following information applies to the questions displayed below) Calvin reviewed his canceled checks and receipts this year (2021) for charitable contributions, which Included an antique painting and IBM stock. He has owned the IBM stock and the painting since 2005 Part 4 015 Done Hobbs Medical Center State Museum A needy family United Way Item TEM stock Antique painting Food and clothes Cash Cost 56,600 5,800 560 24.000 FNV $ 38,000 3,480 340 24.000 4 potica Calculate Calvin's charitable contribution deduction and carryover (if any) under the following circumstances. (Leave no answer blank. Enter zero if applicable.) rence d. Calvin's AG is $180,000 and Hobbs is a private nonoperating foundation Charitable contribution deduction Carrover Submit Help Save & Exit The following information applies to the questions displayed below! Calvin reviewed his canceled checks and receipts this year (2021) for charitable contributions, which included an antique painting and IBM stock. He has owned the IBM stock and the painting since 2005 20 PHY Parts Donec Hobbs Medical Center State Museum A needy family United Way Iter TEM stock Antique painting Food and clothes Cash Cost $ 5,600 5,800 560 24.000 $ 38,020 3,480 340 24,000 4 Calculate Calvin's charitable contribution deduction and carryover (if any) under the following circumstances. (Leave no answer blank, Enter zero if applicable) e. Calvin's AG is $180,000, but the painting is worth $58,000 Chat contribution deduction Curryover WO CH 06 0 Saved Help Save & Exit Submit 21 Simon lost $5,150 gambling this year on a trip to Las Vegas. In addition, he paid $2,090 to his broker for managing his $209,000 portfolio and $1725 to his accountant for preparing his tax return. In addition, Simon incurred $3.170 in transportation costs commuting back and forth from his home to his employer's office, which were not reimbursed, Calculate the amount of these expenses that Simon is able to deduct (assuming he itemizes his deductions)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts