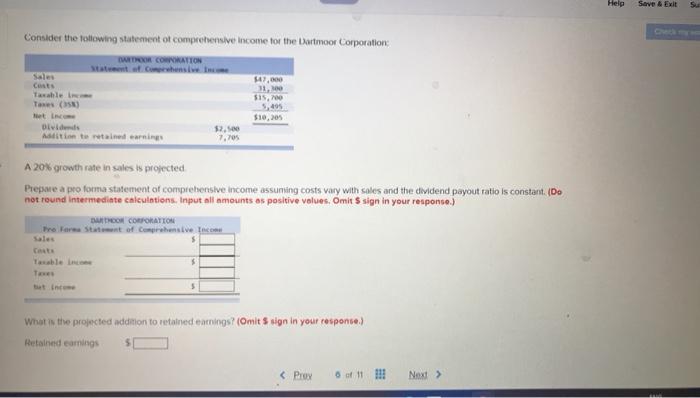

Question: Help Save & Exit Consider the following statement of comprehensive Income for the Lartmoor Corporation WER CORATION Sales 147,000 Cons Taxable in 515,00 Tones (5)

Help Save & Exit Consider the following statement of comprehensive Income for the Lartmoor Corporation WER CORATION Sales 147,000 Cons Taxable in 515,00 Tones (5) 5,405 $10,0 Dividends $2.500 Aadition to retained in 7.70 A 20% growth rate in sales is projected Prepare a pro forma statement of comprehensive income assuming costs vary with sales and the dividend payout ratio is constant. (De not round intermediate calculations. Input all amounts as positive values. Omit S sign in your response.) CON CORPORATION Tre Free State of comprehensive Inc Sales $ $ Tas tin What is the projected addition to retained earnings? (Omit Sign in your response.) Retained earnings

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts