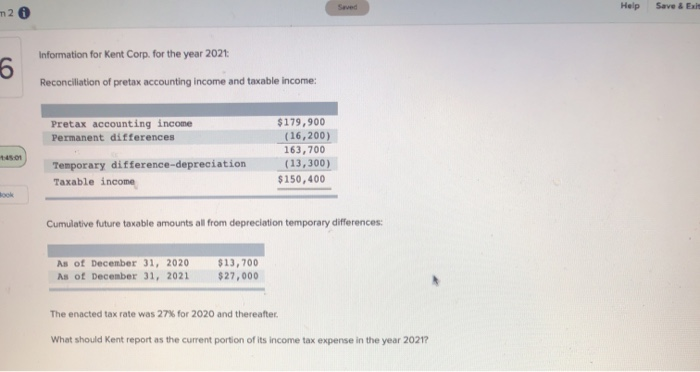

Question: Help Save & Exit m2 Information for Kent Corp. for the year 2021 Reconciliation of pretax accounting income and taxable income: Pretax accounting income Permanent

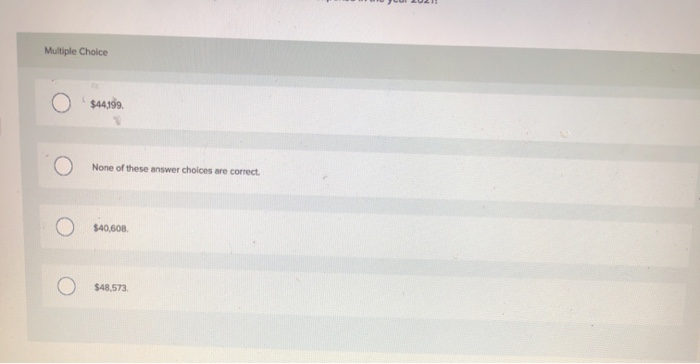

Help Save & Exit m2 Information for Kent Corp. for the year 2021 Reconciliation of pretax accounting income and taxable income: Pretax accounting income Permanent differences $179,900 (16,200) 163,700 (13,300) $150,400 so Temporary difference-depreciation Taxable income Cumulative future taxable amounts all from depreciation temporary differences: As of December 31, 2020 As of December 31, 2021 $13,700 $27,000 The enacted tax rate was 27% for 2020 and thereafter. What should Kent report as the current portion of its income tax expense in the year 2021? Multiple Choice o $44,399. o None of these answer choices are correct o . o

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock