Question: Help Save & Exit Mackenzie is a full-time employee in Austin, Texas, who earns $4,380 per month and is paid semimonthly. She is married filing

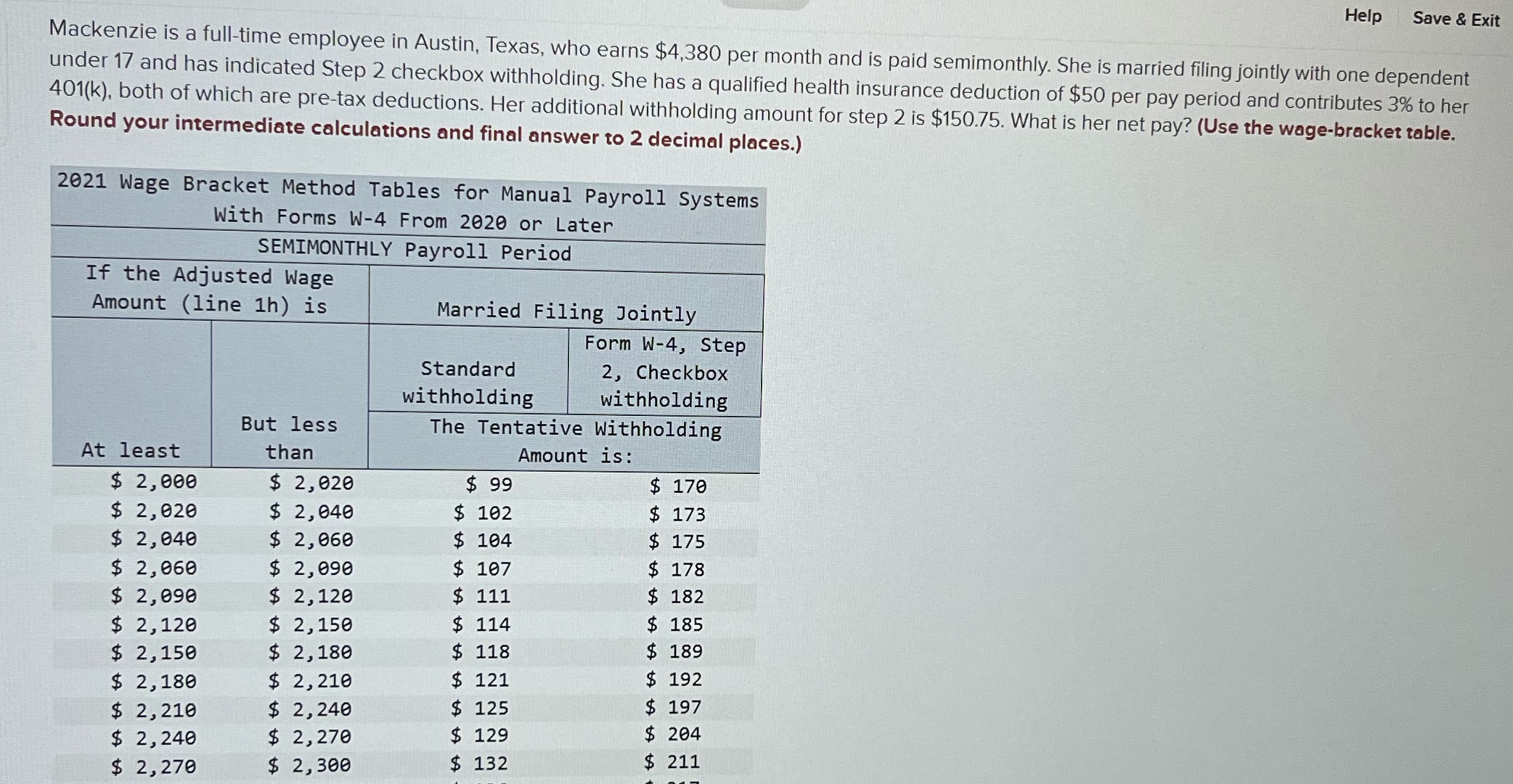

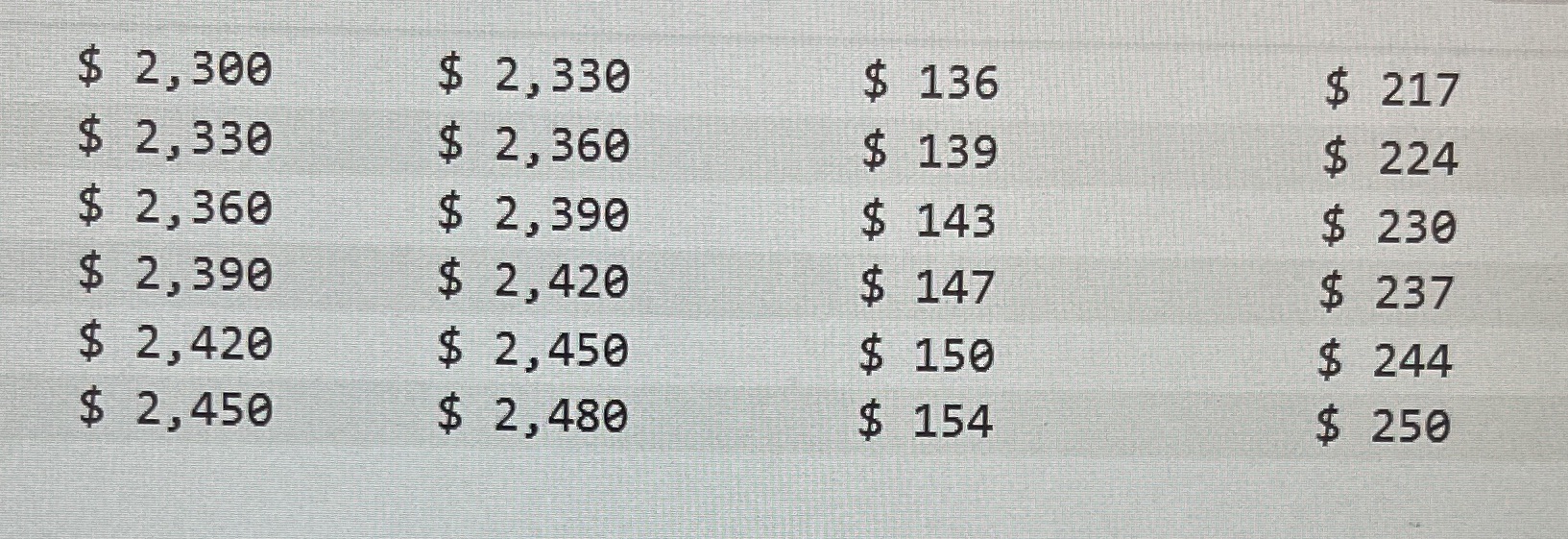

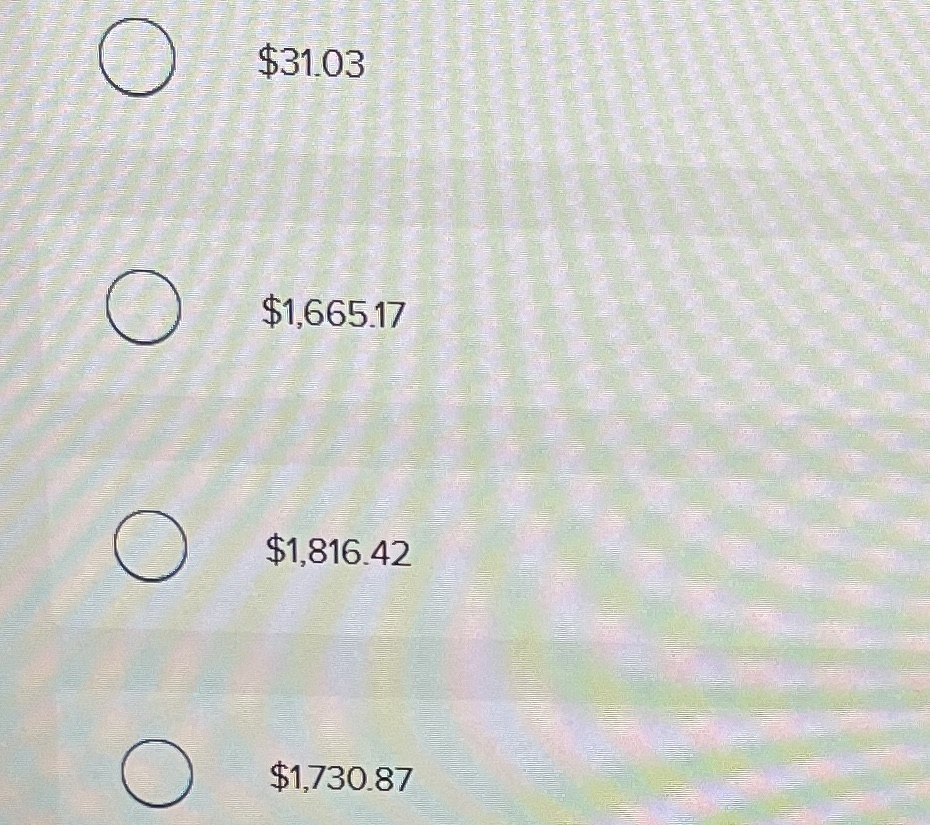

Help Save & Exit Mackenzie is a full-time employee in Austin, Texas, who earns $4,380 per month and is paid semimonthly. She is married filing jointly with one dependent under 17 and has indicated Step 2 checkbox withholding. She has a qualified health insurance deduction of $50 per pay period and contributes 3% to her 401(k), both of which are pre-tax deductions. Her additional withholding amount for step 2 is $150.75. What is her net pay? (Use the wage-bracket table. Round your intermediate calculations and final answer to 2 decimal places.) 2021 Wage Bracket Method Tables for Manual Payroll Systems With Forms W-4 From 2020 or Later SEMIMONTHLY Payroll Period If the Adjusted Wage Amount (line 1h) is Married Filing Jointly Form W-4, Step Standard 2, Checkbox withholding withholding But less The Tentative Withholding At least than Amount is : $ 2,000 $ 2, 020 $ 99 $ 170 $ 2, 020 $ 2, 040 $ 102 $ 173 $ 2, 040 $ 2, 060 $ 104 $ 175 $ 2, 060 $ 2, 090 $ 107 $ 178 $ 2, 090 $ 2, 120 $ 111 $ 182 $ 2, 120 $ 2, 150 $ 114 $ 185 $ 2, 150 $ 2, 180 $ 118 $ 189 $ 2, 180 $ 2, 210 $ 121 $ 192 $ 2, 210 $ 2, 240 $ 125 $ 197 $ 2, 240 $ 2, 270 $ 129 $ 204 $ 2, 270 $ 2, 300 $ 132 $ 211$ 2, 300 $ 2, 330 $ 136 $ 217 $ 2, 330 $ 2, 360 $ 139 $ 224 $ 2, 360 $ 2, 390 $ 143 $ 230 $ 2, 390 $ 2, 420 $ 147 $ 237 $ 2, 420 $ 2, 450 $ 150 $ 244 $ 2, 450 $ 2, 480 $ 154 $ 250\f

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts