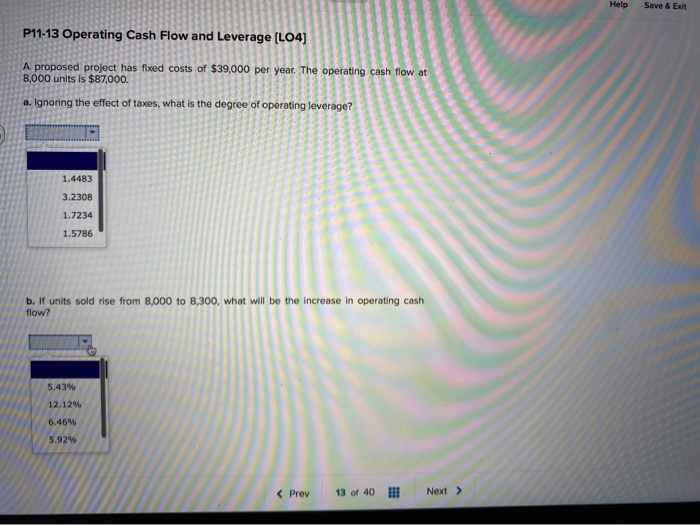

Question: Help Save & Exit P11-13 Operating Cash Flow and Leverage (L04) A proposed project has fixed costs of $39,000 per year. The operating cash flow

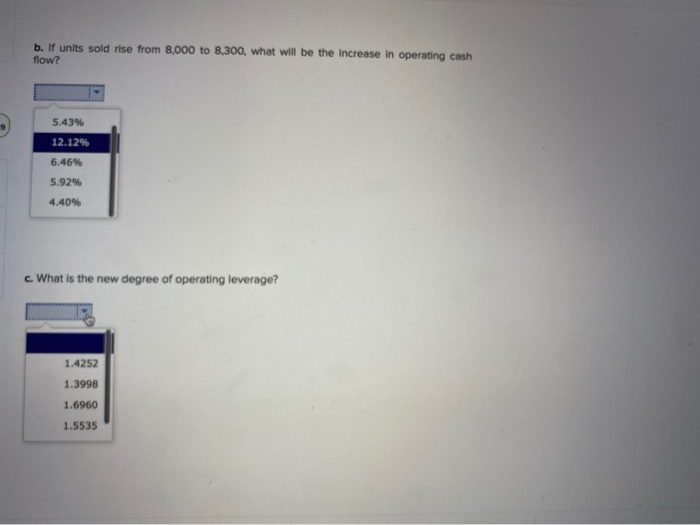

Help Save & Exit P11-13 Operating Cash Flow and Leverage (L04) A proposed project has fixed costs of $39,000 per year. The operating cash flow 8,000 units is $87,000. a. Ignoring the effect of taxes, what is the degree of o perating leverage? 1.4483 3.2308 1.7234 1.5786 b. If units sold rise from 8,000 to 8,300, what will be the increase in operating cash flow? 5.43% 12.129 6.46% 5.92% b. If units sold rise from 8,000 to 8,300, what will be the increase in operating cash flow? 5.43% 12.12% 6.46% 5.92% 4.40% c. What is the new degree of operating leverage? 1.4252 1.3998 1.6960 1.5535

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts