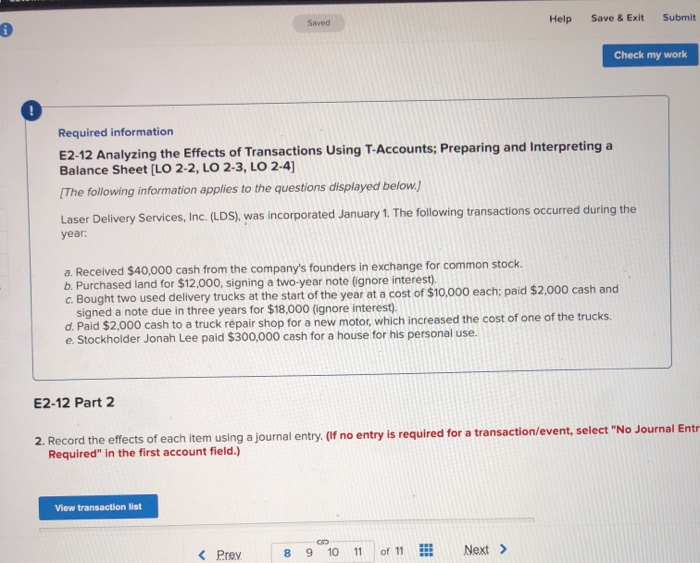

Question: Help Save & Exit Saved Submit Check my work ! Required information E2-12 Analyzing the Effects of Transactions Using T-Accounts; Preparing and Interpreting a Balance

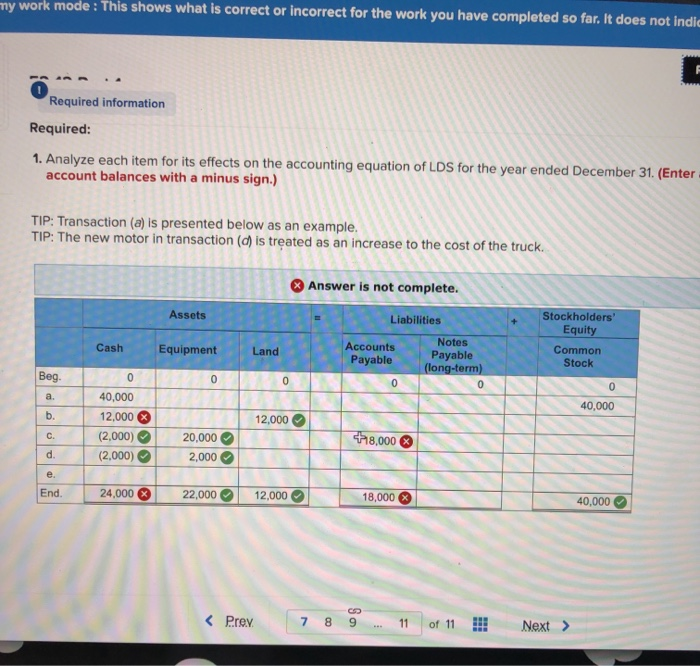

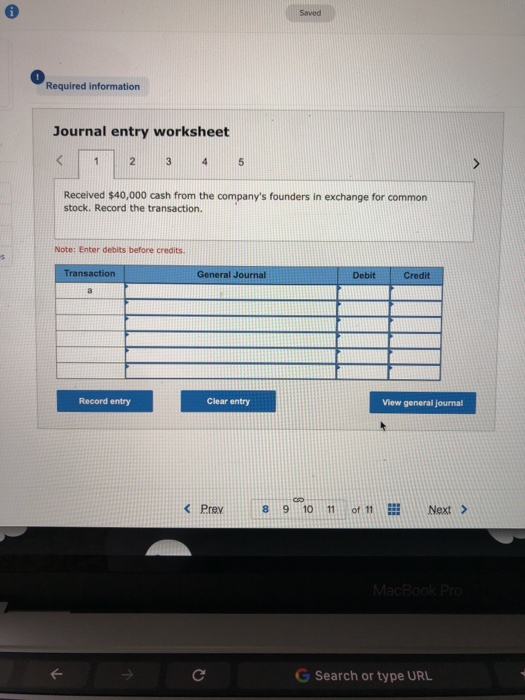

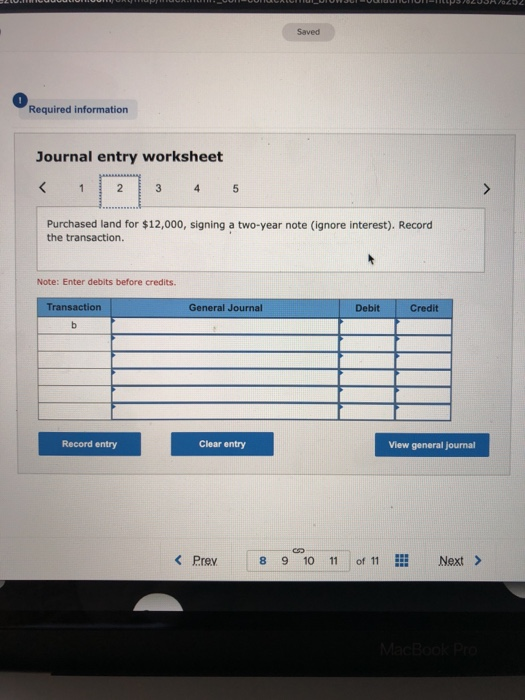

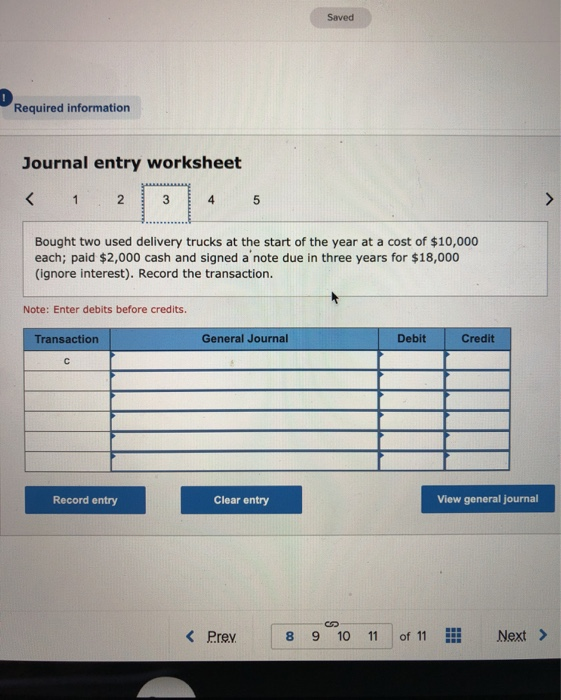

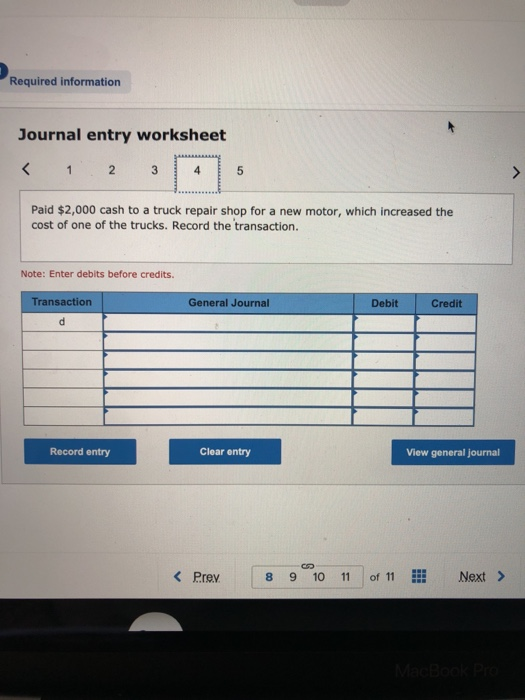

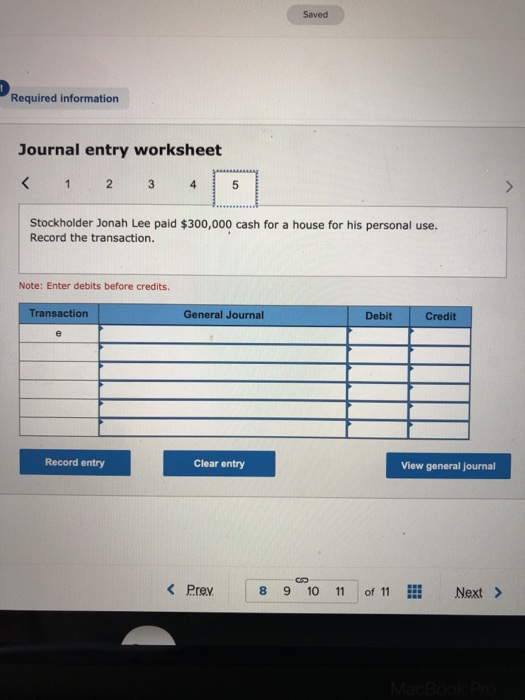

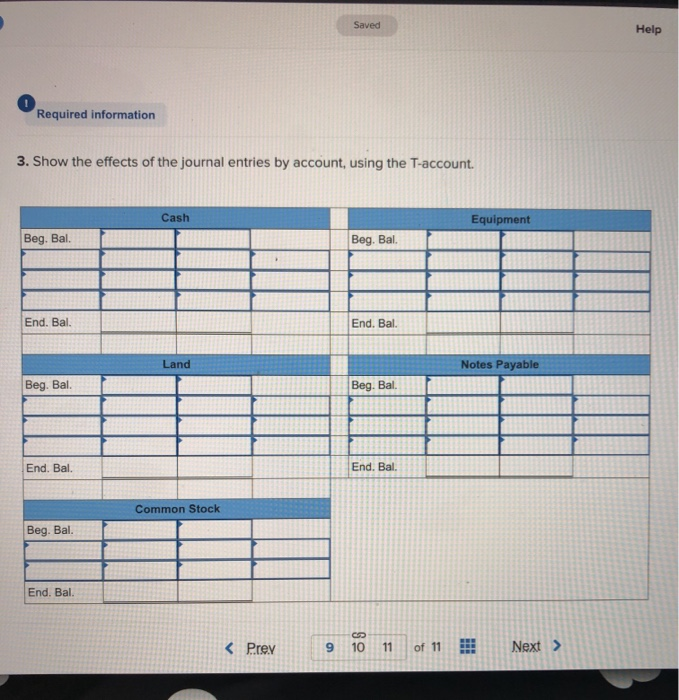

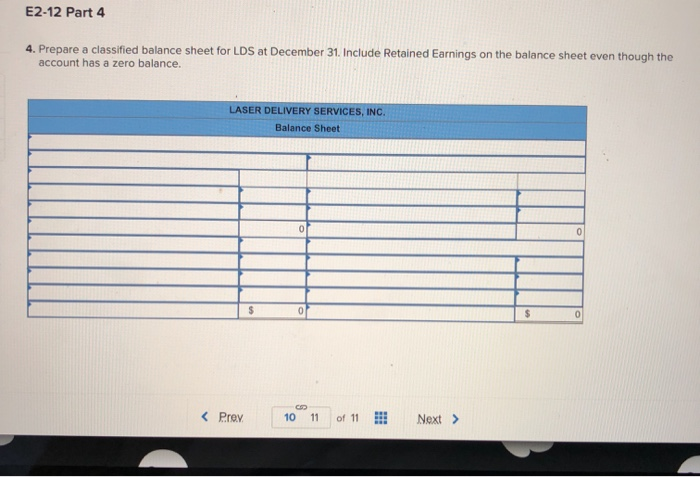

Help Save & Exit Saved Submit Check my work ! Required information E2-12 Analyzing the Effects of Transactions Using T-Accounts; Preparing and Interpreting a Balance Sheet [LO 2-2, LO 2-3, LO 2-4) [The following information applies to the questions displayed below.) Laser Delivery Services, Inc. (LDS), was incorporated January 1. The following transactions occurred during the year: a. Received $40,000 cash from the company's founders in exchange for common stock. b. Purchased land for $12,000, signing a two-year note (ignore interest). c. Bought two used delivery trucks at the start of the year at a cost of $10,000 each; paid $2,000 cash and signed a note due in three years for $18,000 (ignore interest). d. Paid $2,000 cash to a truck repair shop for a new motor, which increased the cost of one of the trucks. e. Stockholder Jonah Lee paid $300,000 cash for a house for his personal use. E2-12 Part 2 2. Record the effects of each item using a journal entry. (If no entry is required for a transaction/event, select "No Journal Entr Required" in the first account field.) View transaction list my work mode : This shows what is correct or incorrect for the work you have completed so far. It does not indic Required information Required: 1. Analyze each item for its effects on the accounting equation of LDS for the year ended December 31. (Enter account balances with a minus sign.) TIP: Transaction (a) is presented below as an example. TIP: The new motor in transaction () is treated as an increase to the cost of the truck. Answer is not complete. Assets Stockholders Equity Common Cash Equipment Liabilities Accounts Notes Payable Payable (long-term) 0 Land Stock Beg 0 0 0 40,000 0 40,000 b. 12,000 C. 12,000 (2,000) (2,000) 20,000 2,000 +78,000 d. e. End 24,000 22,000 12,000 18,000 40,000 Saved Required information Journal entry worksheet 1 2 3 4 5 Received $40,000 cash from the company's founders in exchange for common stock. Record the transaction. Note: Enter debits before credits. $ Transaction General Journal Debit Credit Record entry Clear entry View general journal MacBook Pro G Search or type URL Saved Required information Journal entry worksheet MacBoo Pie Saved Required information Journal entry worksheet Required information Journal entry worksheet 1 2 3 4 5 Paid $2,000 cash to a truck repair shop for a new motor, which increased the cost of one of the trucks. Record the transaction. Note: Enter debits before credits. Transaction General Journal Debit Credit d Record entry Clear entry View general journal MacBooK PE Saved Required information Journal entry worksheet 1 2 3 4 5 Stockholder Jonah Lee paid $300,000 cash for a house for his personal use. Record the transaction. Note: Enter debits before credits. Transaction General Journal Debit Credit Record entry Clear entry View general Journal MERCEDES Saved Help Required information 3. Show the effects of the journal entries by account, using the T-account. Cash Equipment Beg. Bal. Beg. Bal End. Bal. End. Bal. Land Notes Payable Beg. Bal. Beg. Bal. End. Bal. End. Bal. Common Stock Beg. Bal. End. Bal. E2-12 Part 4 4. Prepare a classified balance sheet for LDS at December 31. Include Retained Earnings on the balance sheet even though the account has a zero balance. LASER DELIVERY SERVICES, INC. Balance Sheet 0 $ 0

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts