Question: Help Save & Exit Seved Submit work Check my work Mrs. Franklin, who is in the 37 percent tax bracket, owns a residential apartment building

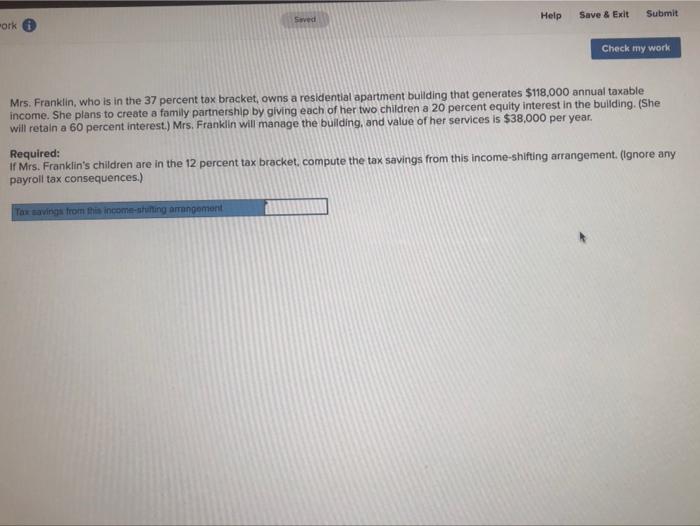

Help Save & Exit Seved Submit work Check my work Mrs. Franklin, who is in the 37 percent tax bracket, owns a residential apartment building that generates $118,000 annual taxable income. She plans to create a family partnership by giving each of her two children a 20 percent equity interest in the building. (She will retain a 60 percent interest.) Mrs. Franklin will manage the building, and value of her services is $38,000 per year. Required: If Mrs. Franklin's children are in the 12 percent tax bracket, compute the tax savings from this income-shifting arrangement. (Ignore any payroll tax consequences.) The savings from the income-string arrangement

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts