Question: Help Save & Exit Sub 4 Timberly Construction negotiates a lump sum purchase of several assets from a company that is going out of business.

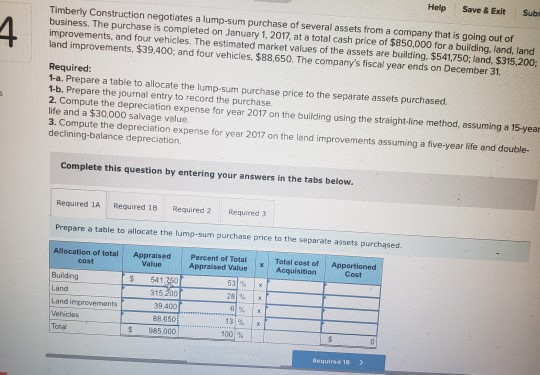

Help Save & Exit Sub 4 Timberly Construction negotiates a lump sum purchase of several assets from a company that is going out of business. The purchase is completed on January 1, 2017, at a total cash price of $850,000 for a building, land, land improvements, and four vehicles. The estimated market values of the assets are building, $541750; land, $315.200 land improvements, $39,400, and four vehicles, $88,650. The company's fiscal year ends on December 31 Required: 1-a. Prepare a table to allocate the lump sum purchase price to the separate assets purchased 1-b. Prepare the journal entry to record the purchase 2. Compute the depreciation expense for year 2017 on the building using the straight-line method, assuming a 15-year life and a $30,000 salvage value. 3. Compute the depreciation expense for year 2017 on the land improvements assuming a five-year life and double- declining balance depreciation Complete this question by entering your answers in the tabs below. Required LA Required 1B Required 2 Required Prepare a table to allocate the lump-sum purchase price to the separate assets purchased Allocation of total cost Percent of Total Appraised Value 53% Total cost of Acquisition Appartioned Cost x Building Land Land improvements Vehicles Total Appraised Value S 541 250 315, 200 39,400 88.650 $ 985.000 28 6 X 131 100%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts