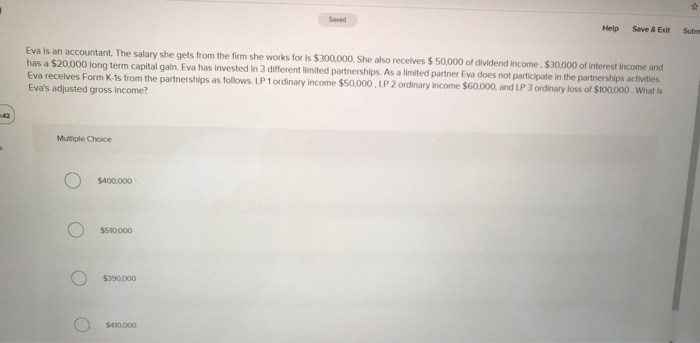

Question: Help Save & Exit Sub Eva is an accountant. The salary she gets from the firm she works for is $300,000. She also receives $50,000

Help Save & Exit Sub Eva is an accountant. The salary she gets from the firm she works for is $300,000. She also receives $50,000 of dividend Income. $30,000 of interest Income and has a $20,000 long term capital gain. Eva has invested in 3 different limited partnerships. As a limited partner Eva does not participate in the partnerships activities Eva receives Form K-Is from the partnerships as follows. LP1 ordinary income $50,000, LP 2 ordinary income $60,000, and LP 3 ordinary loss of $100,000. What is Eva's adjusted gross income? o $400.000 o $390,000 10000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts