Question: Help Save & Exit Sube Required information The following information applies to the questions displayed below! El Dorado Foods Inc. owns a chain of specialty

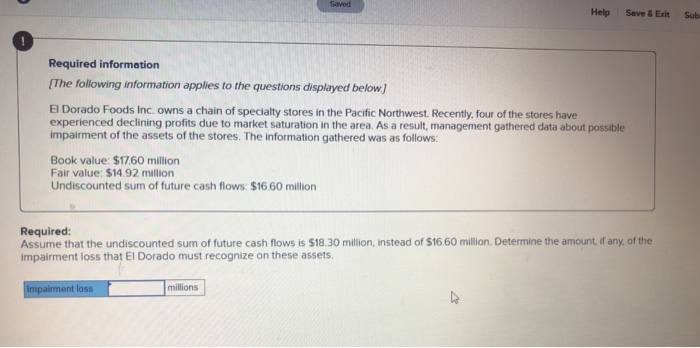

Help Save & Exit Sube Required information The following information applies to the questions displayed below! El Dorado Foods Inc. owns a chain of specialty stores in the Pacific Northwest. Recently, four of the stores have experienced declining profits due to market saturation in the area. As a result, management gathered data about possible impairment of the assets of the stores. The information gathered was as follows: Book value: $17.60 million Fair value: $14.92 million Undiscounted sum of future cash flows: $16 60 million Required: Assume that the undiscounted sum of future cash flows is $18.30 million, instead of $16.60 million. Determine the amount, if any, of the impairment loss that El Dorado must recognize on these assets. Impairment loss millions

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts