Question: Help Save& Exit Submi omework Martinez, Inc. acquired a patent on January 1,2017 for $41,500 cash. The patent was estimated to have a useful life

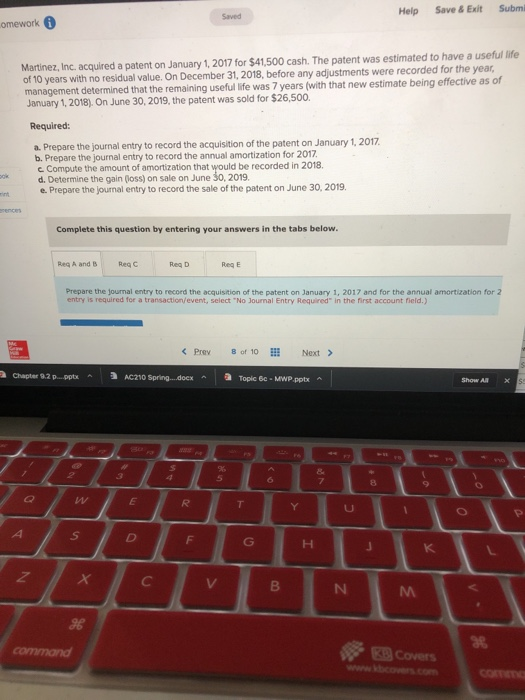

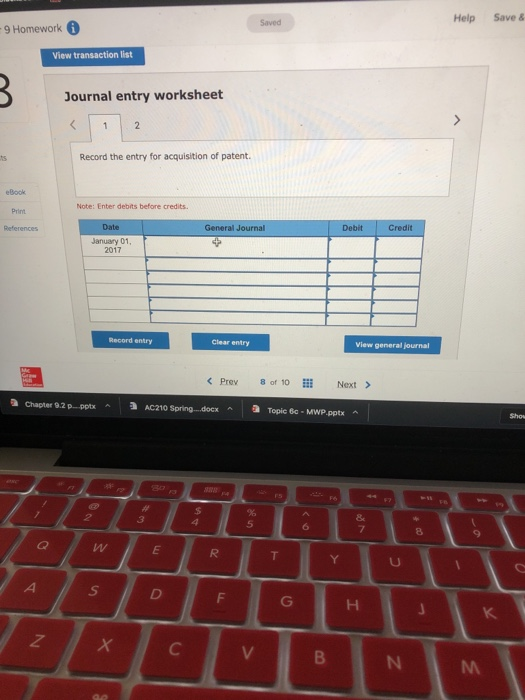

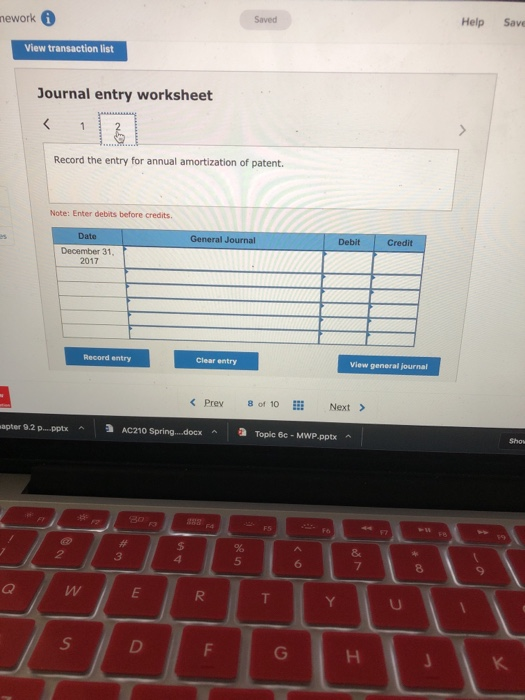

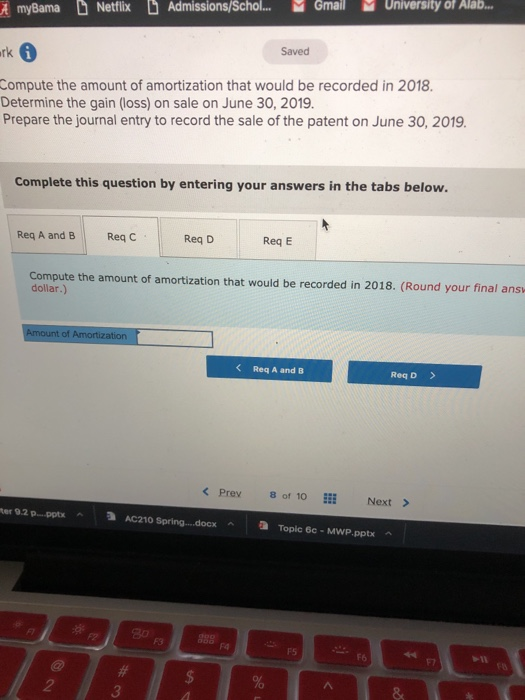

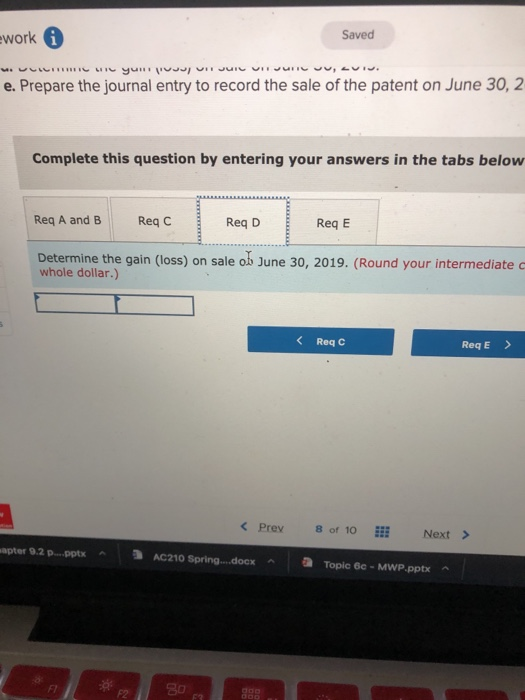

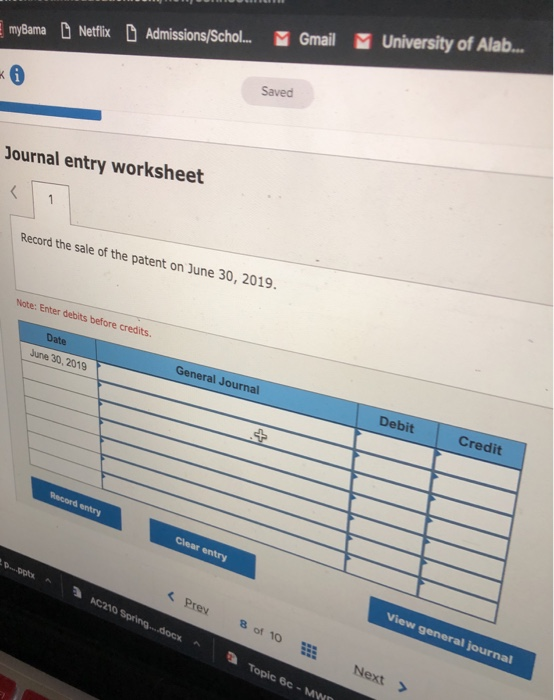

Help Save& Exit Submi omework Martinez, Inc. acquired a patent on January 1,2017 for $41,500 cash. The patent was estimated to have a useful life of 10 years with no residual value. On December 31, 2018, before any adjustments were recorded for the year management determined that the remaining useful life was 7 years (with that new estimate being effective as of January 1, 2018). On June 30, 2019, the patent was sold for $26,500 Required: a. Prepare the journal entry to record the acquisition of the patent on January 1, 2017 b. Prepare the journal entry to record the annual amortization for 2017 c Compute the amount of amortization that would be recorded in 2018 d. Determine the gain (oss) on sale on June 30, 2019. e. Prepare the journal entry to record the sale of the patent on June 30, 2019. Complete this question by entering your answers in the tabs below Req A and B Req C Req D Req E Prepare the journal entry to record the acquisition of the patent on January 1, 2017 and for the annual amortization for 2 entry is required for a transaction/event, select "No Journal Entry Required" in the first account field.) Chapter 92p., pptx AC210 Spring dox ^ a Topic 6c-MWP.pptx ^ ^ Show Alx 8 Help Save & 9 Homework 6 View transaction list ournal entry worksheet Record the entry for acquisition of patent. Note: Enter debits before credits. Print General Journal Debit Credit January 01 2017 Record entry Clear entry View general journal Chapter 92 p_.pptx ^ AC210 Spring docx ^ 3 5 8 nework Help Save View transaction list Journal entry worksheet Record the entry for annual amortization of patent. Note: Enter debits before credits ate General Journal December 31 2017 Record entry Clear entry View general journal 8 5 AmyBama Netflix Admissions/Scho.... Gmail University of Alab rk Saved Compute the amount of amortization that would be recorded in 2018 Determine the gain (loss) on sale on June 30, 2019. Prepare the journal entry to record the sale of the patent on June 30, 2019 Complete this question by entering your answers in the tabs below. Req A and B Req C Req D Req E Compute the amount of amortization that would be recorded in 2018. (Round your final ans dollar.) of Topic 6c-MWP.pptx F5 F7 2 3 work Saved e. Prepare the journal entry to record the sale of the patent on June 30, 2 Complete this question by entering your answers in the tabs below Req A and B Req C Req D Req E Determine the gain (loss) on sale os June 30, 2019. (Round your intermediate c whole dollar.) Req C Req E>

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts