Question: Help Save & Exit Submit 14 Kim received a 1/3 profits and capital interest in Bright Line, LLC in exchange for legal services she provided.

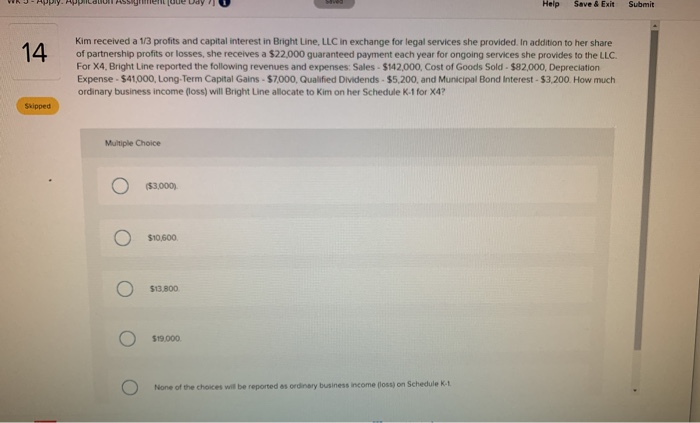

Help Save & Exit Submit 14 Kim received a 1/3 profits and capital interest in Bright Line, LLC in exchange for legal services she provided. In addition to her share of partnership profits or losses, she receives a $22,000 guaranteed payment each year for ongoing services she provides to the LLC. For X4, Bright Line reported the following revenues and expenses: Sales - $142,000, Cost of Goods Sold - $82,000, Depreciation Expense - $41,000, Long-Term Capital Gains - 57000, Qualified Dividends - $5,200, and Municipal Bond Interest - $3,200. How much ordinary business income (loss) will Bright Line allocate to Kim on her Schedule K-1 for X4? Skipped Multiple Choice ($3,000) $10,600 $13.800 $19.000 None of the choices will be reported as ordinary business income foss) on Schedule 1

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts