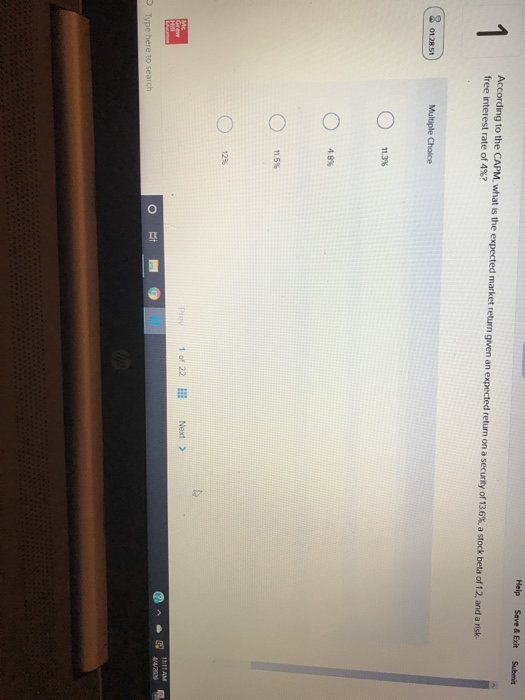

Question: Help Save & Exit Submit According to the CAPM, what is the expected market return given an expected return on a security of 136% a

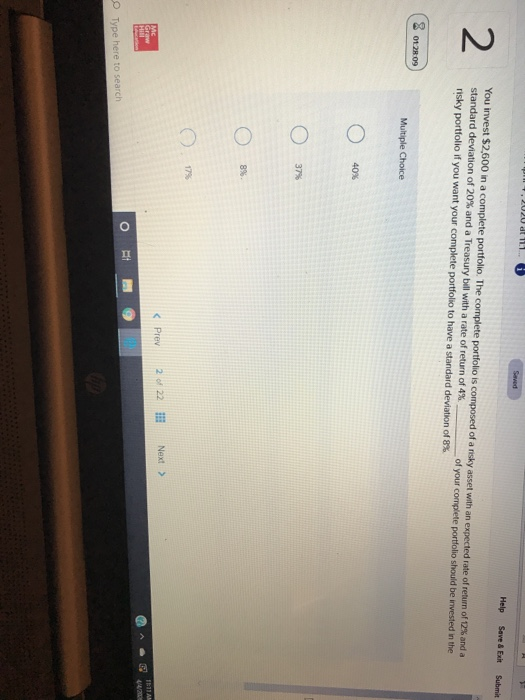

Help Save & Exit Submit According to the CAPM, what is the expected market return given an expected return on a security of 136% a stock beta of 12 and ansk- free interest rate of 4%? 2 012851 Multiple Choice Oo oo Prev 1 of 22 Next > ce 4142020 Type here to search Help Save & Exit Submit You invest $2,600 in a complete portfolio. The complete portfolio is composed of a risky asset with an expected rate of return of 12% and a standard deviation of 20% and a Treasury bill with a rate of return of 4% of your complete portfolio should be invested in the risky portfolio if you want your complete portfolio to have a standard deviation of 8% (3 28 09 Multiple Choice o o o Prev 2 22 Next . 9 Type here to search

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts