Question: Help Save & Exit Submit Baird Brothers Construction is considering the purchase of a machine at a cost of $ 1 3 5 , 0

Help

Save & Exit

Submit

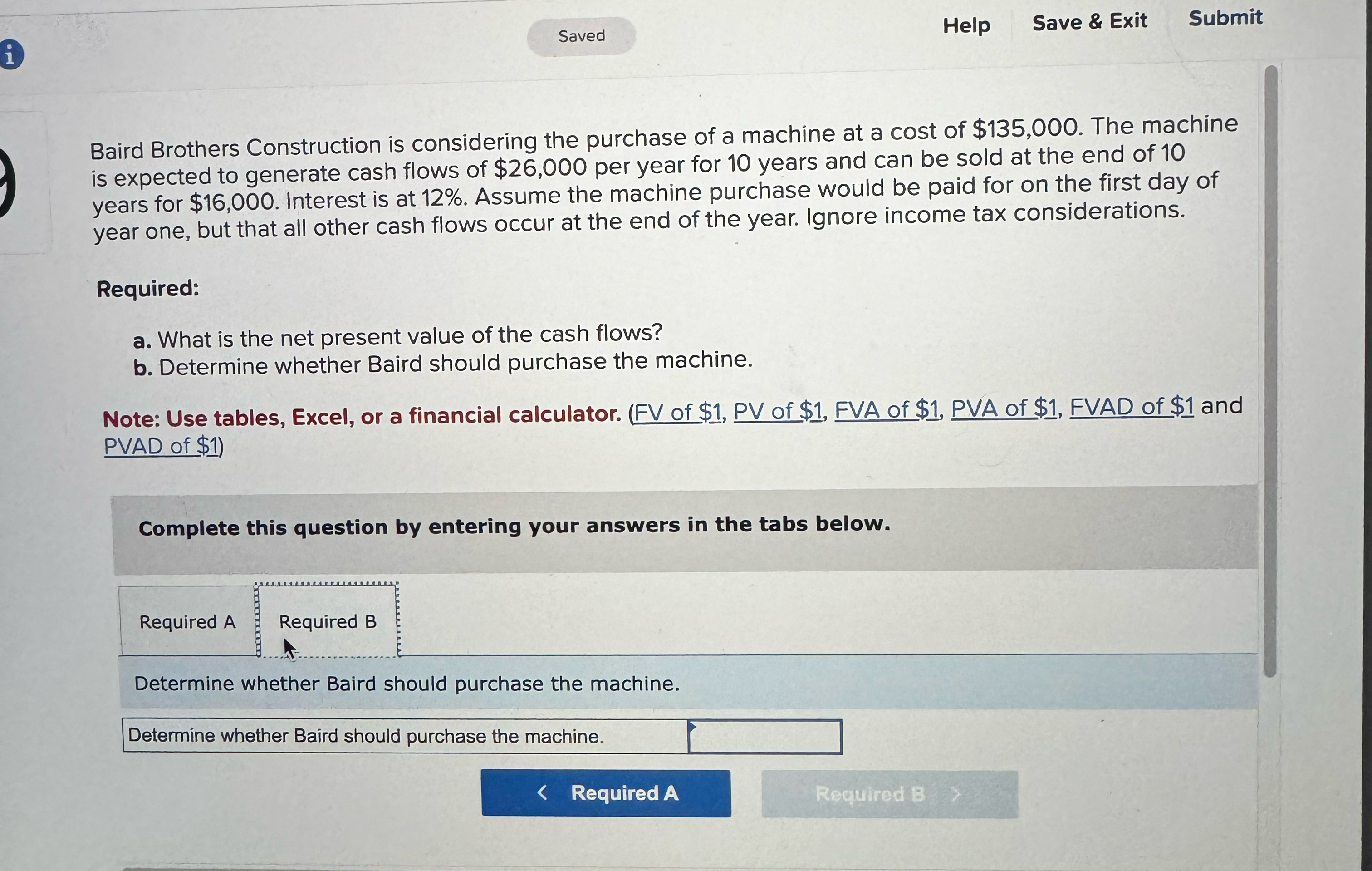

Baird Brothers Construction is considering the purchase of a machine at a cost of $ The machine is expected to generate cash flows of $ per year for years and can be sold at the end of years for $ Interest is at Assume the machine purchase would be paid for on the first day of year one, but that all other cash flows occur at the end of the year. Ignore income tax considerations.

Required:

a What is the net present value of the cash flows?

b Determine whether Baird should purchase the machine.

Note: Use tables, Excel, or a financial calculator. FV of $ PV of $ FVA of $ PVA of $ FVAD of $ and PVAD of $

Complete this question by entering your answers in the tabs below.

Required

Required B

What is the net present value of the tash flows?

Note: Round your intermediate and final answer to nearest whole dollar.

Net present value

Help

Save & Exit

Submit

Baird Brothers Construction is considering the purchase of a machine at a cost of $ The mache is expected to generate cash flows of $ per year for years and can be sold at the end of years for $ Interest is at Assume the machine purchase would be paid for on the first day of year one, but that all other cash flows occur at the end of the year. Ignore income tax considerations.

Required:

a What is the net present value of the cash flows?

b Determine whether Baird should purchase the machine.

Note: Use tables, Excel, or a financial calculator. FV of $ PV of $ FVA of $ PVA of $ FVAD of $ and PVAD of $

Complete this question by entering your answers in the tabs below.

Required

Required B

Determine whether Baird should purchase the machine.

Determine whether Baird should purchase the machine.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock