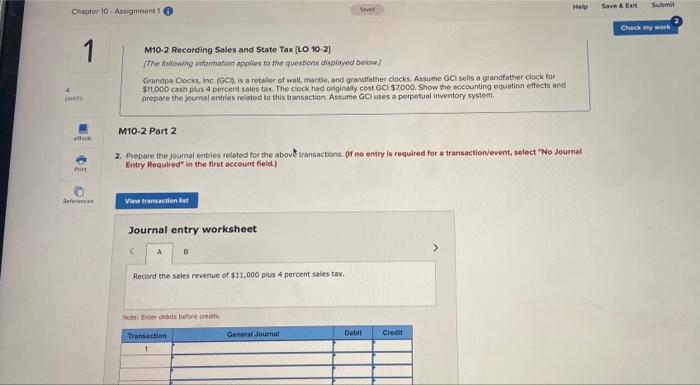

Question: Help Save & Exit Submit Chapter 10: Assignment Check my world 1 M10-2 Recording Sales and State Tax (LO 10-2) The following information applies to

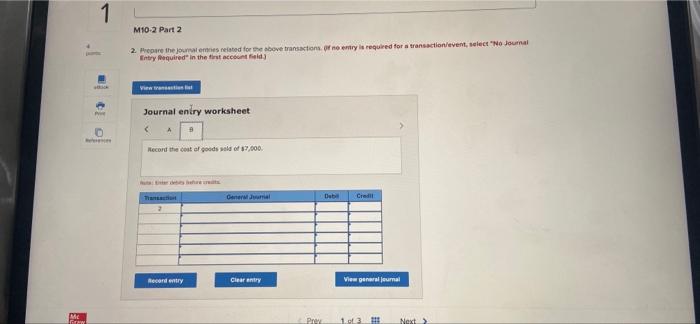

Help Save & Exit Submit Chapter 10: Assignment Check my world 1 M10-2 Recording Sales and State Tax (LO 10-2) The following information applies to the questions displayed below! Grandpa Clocks, Inc (GC, is a retaler of wall, mantle, and grandfather clocks. Assume GC sells a grandfather clock for 511000 cash plus & percent seles tax The clock had originally cost GCI $7000. Show the accounting ustion effects and prepare the journal entries related to this transaction Assume GCiutes a perpetual inventory system 4 M10-2 Part 2 2. Prepare the joumal entries related for the above transactions of no entry is required for a transaction/event, select "No Journal Entry Required in the first account field.) Pro Reference View transaction et Journal entry worksheet Record the sales revenue of $11,000 plus 4 percent sales tax Note bereits before credits Transaction General Journal Debit Credit 1 1 M10-2 Part 2 2. Prepare the ones related for the above transactions of nority is required for a transaction event, select "No Journal Entry Required in the first accountfield Journal entry worksheet Record the cost of goods sold of 87.000 General Dube Cred 2 Record entry Clear entry View generalernal ME Prey 13 HE Next >

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts