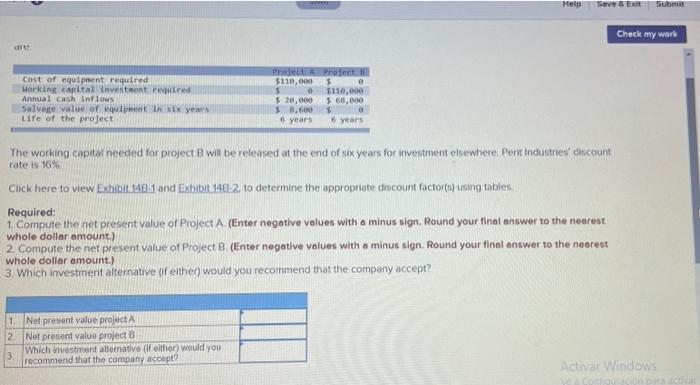

Question: Help Save & Exit Submit Check my work die Cost of equipment required Working capital investment required Annual cash inflows Salvage value of equipment in

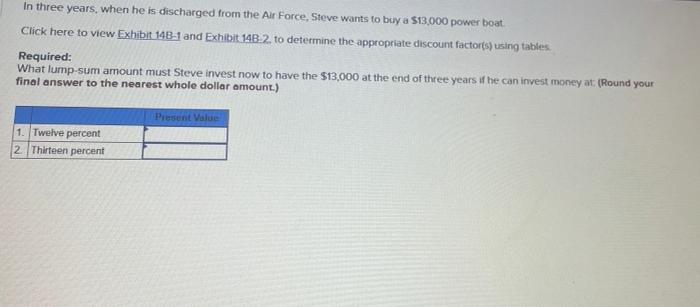

Help Save & Exit Submit Check my work die Cost of equipment required Working capital investment required Annual cash inflows Salvage value of equipment in six years Life of the project Project A project in $110,00 $ 0 $110,000 $ 20,000 $ 60.000 $ 0.00 1 6 years 6 years The working captat needed for project will be released at the end of six years for investment ehewhere. Pern Industries discount rate is 16% Click here to view Exhib1:1481 and Exhibit 148 2. to determine the appropriate discount factor(s) uning tables Required: 1. Compute the net present value of Project A (Enter negative values with a minus sign. Round your final answer to the nearest whole dollar amount.) 2. Compute the net present value of Project B (Enter negative values with a minus sign. Round your final answer to the nearest whole dollar amount.) 3. Which investment alternative (if either would you recommend that the company accept? 1 2 Net present value project A Net present value project Which investment alternative di other) would you recommend that the company acopt? 3 Activar Windows In three years, when he is discharged from the Air Force, Steve wants to buy a 513,000 power boat Click here to view Exhibit 148-1 and Exhibit 14B-2, to determine the appropriate discount factors) using tables Required: What lump sum amount must Steve invest now to have the $13,000 at the end of three years if he can invest money at, (Round your final answer to the nearest whole dollar amount.) Present Value 1. Twelve percent 2. Thirteen percent

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts