Question: Help Save & Exit Submit Check my work Margo, a calendar year taxpayer, paid $580,000 for new machinery (seven-year recovery property) placed in service on

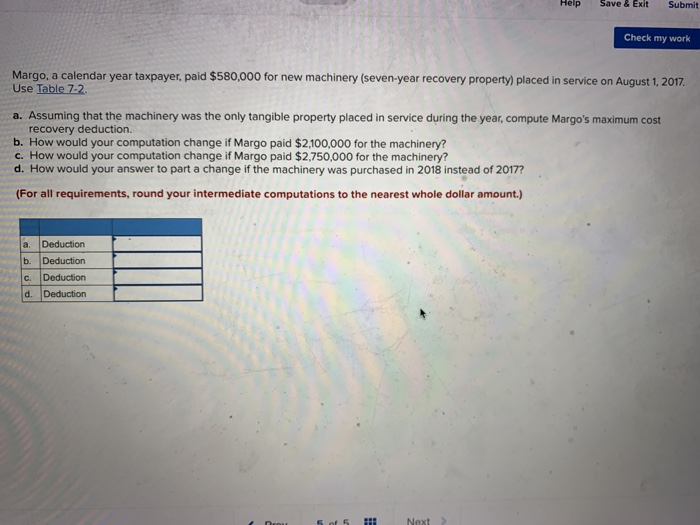

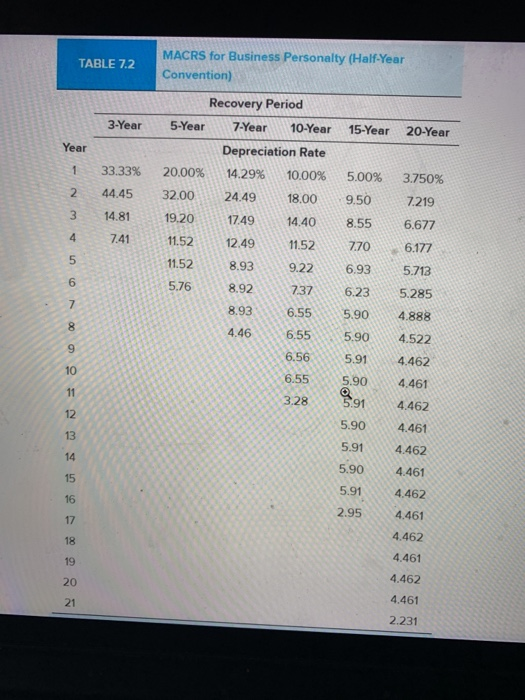

Help Save & Exit Submit Check my work Margo, a calendar year taxpayer, paid $580,000 for new machinery (seven-year recovery property) placed in service on August 1,2017 Use Table 7:2. a. Assuming that the machinery was the only tangible property placed in service during the year, compute Margo's maximum cost recovery deduction. b. How would your computation change if Margo paid $2,100,000 for the machinery? c. How would your computation change if Margo paid $2,750,000 for the machinery? d. How would your answer to part a change if the machinery was purchased in 2018 instead of 20177 (For all requirements, round your intermediate computations to the nearest whole dollar amount.) a. Deduction b. Deduction c. Deduction d. Next MACRS for Business Personalty (Half Year Convention) TABLE 7.2 Recovery Period 3-Year 5-Year 7.Year 10-Year 15-Year 20-Year Depreciation Rate Year 1 33.33% 20.00% 14.29% 10.00% 5.00% 3.750% 2 44.45 32.00 24.4918.00 9.50 7219 3 14.8119.20 17491440 8.55 6677 4 74111.52 12.4911.52 770 6.177 11.528.939.22 6.935713 737 6.23 5.285 8.936.555.90 4888 4.46 6.555.904.522 6.56 5.914.462 6.55 5.90 4.461 5.914.462 5.90 4.461 5.914.462 5.90 4.461 591 4.462 2.954.461 4.462 4.461 4.462 4.461 2.231 5 6 5.76 8.92 10 3.28 12 13 14 15 16 17 18 19 20 21

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts