Question: Help Save & Exit Submit Check my work Problem 20-13 Valuation of a Merger (LG20-2) Stubborn Motors, Inc. is asking a price of $79 million

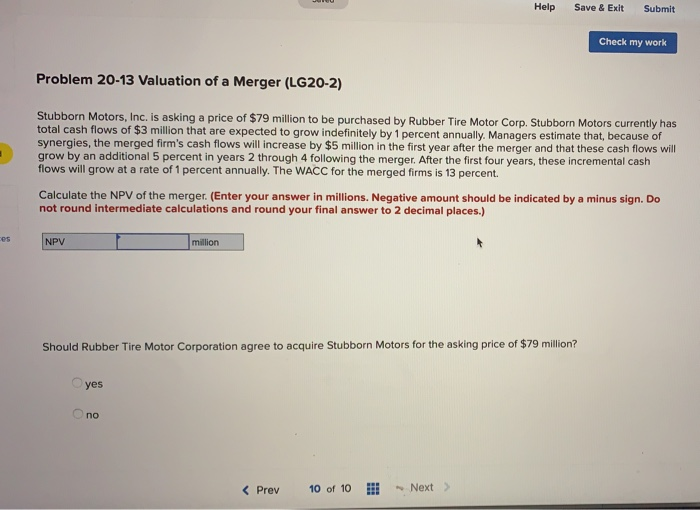

Help Save & Exit Submit Check my work Problem 20-13 Valuation of a Merger (LG20-2) Stubborn Motors, Inc. is asking a price of $79 million to be purchased by Rubber Tire Motor Corp. Stubborn Motors currently has total cash flows of $3 million that are expected to grow indefinitely by 1 percent annually. Managers estimate that, because of synergies, the merged firm's cash flows will increase by $5 million in the first year after the merger and that these cash flows will grow by an additional 5 percent in years 2 through 4 following the merger. After the first four years, these incremental cash flows will grow at a rate of 1 percent annually. The WACC for the merged firms is 13 percent. Calculate the NPV of the merger. (Enter your answer in millions. Negative amount should be indicated by a minus sign. Do not round intermediate calculations and round your final answer to 2 decimal places.) NPV million Should Rubber Tire Motor Corporation agree to acquire Stubborn Motors for the asking price of $79 million? yes no

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts