Question: Help Save & Exit Submit Cutter Enterprises purchased equipment for $69,000 on January 1, 2016. The equipment is expected to have a five-year life and

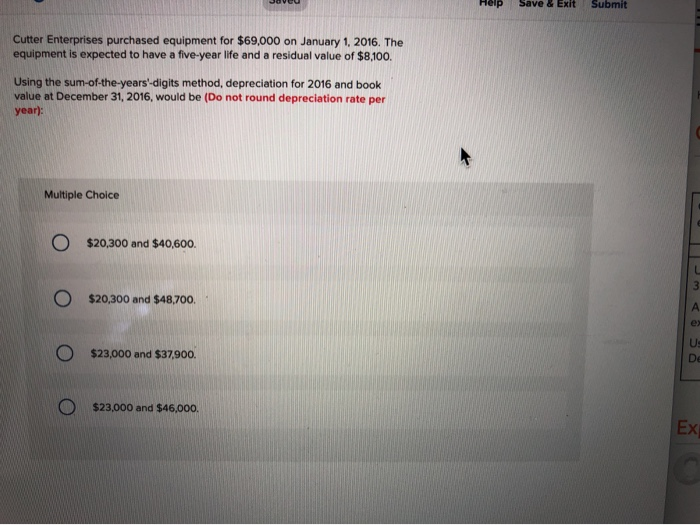

Help Save & Exit Submit Cutter Enterprises purchased equipment for $69,000 on January 1, 2016. The equipment is expected to have a five-year life and a residual value of $8,100. Using the sum-of-the-years-digits method, depreciation for 2016 and book value at December 31, 2016, would be (Do not round depreciation rate per year): Multiple Choice $20,300 and $40,600. $20,300 and $48,700. e. Us $23,000 and $37,900. D $23,000 and $46,000. Ex ACSE

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts