Question: Help Save & Exit Submit my work mode : This shows what is correct or incorrect for the work you have completed so far. It

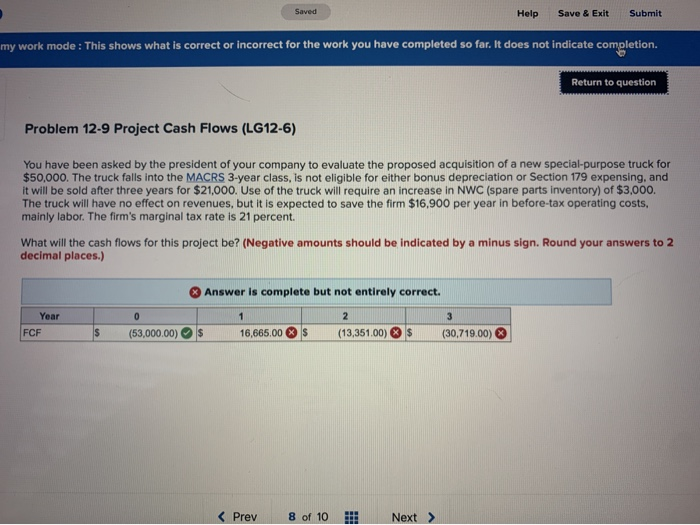

Help Save & Exit Submit my work mode : This shows what is correct or incorrect for the work you have completed so far. It does not indicate completion. Return to question Problem 12-9 Project Cash Flows (LG12-6) You have been asked by the president of your company to evaluate the proposed acquisition of a new special-purpose truck for $50,000. The truck falls into the MACRS 3-year class, is not eligible for either bonus depreciation or Section 179 expensing, and It will be sold after three years for $21,000. Use of the truck will require an increase in NWC (spare parts inventory) of $3,000. The truck will have no effect on revenues, but it is expected to save the firm $16,900 per year in before-tax operating costs, mainly labor. The firm's marginal tax rate is 21 percent. What will the cash flows for this project be? (Negative amounts should be indicated by a minus sign. Round your answers to 2 decimal places.) Answer is complete but not entirely correct. Year FCF 0 (53,000.00) S $ 16,665,00 S (13,351.00) $ (30,719.00)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts