Question: Help Save & Exit Submit St. Louis Co, and St. Romuald Co. are identical firms in all respects except for their capital structure. St Louis

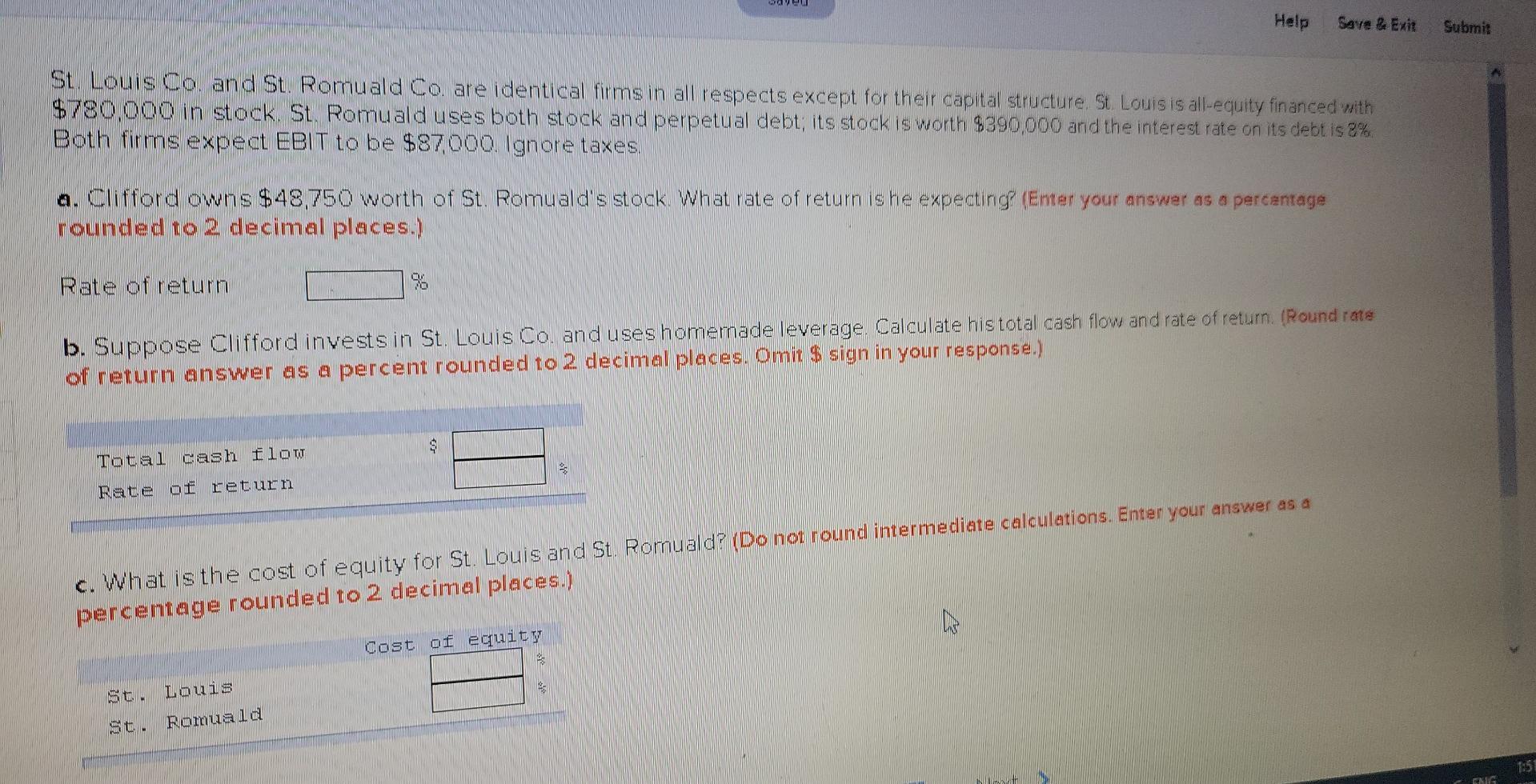

Help Save & Exit Submit St. Louis Co, and St. Romuald Co. are identical firms in all respects except for their capital structure. St Louis is all-equity financed with $780,000 in stock. St. Romuald uses both stock and perpetual debt; its stock is worth $390,000 and the interest rate on its debt is 8% Both firms expect EBIT to be $87000. Ignore taxes. a. Clifford owns $48,750 worth of St. Romuald's stock What rate of retum ishe expecting (Emer your answer as a percentage rounded to 2 decimal places.) Rate of return 94 b. Suppose Clifford investsin St. Louis Co. and uses homemade leverage Calculate his total cash flow and rate of return (Round me of return answer as a percent rounded to 2 decimal places. Omit $ sign in your response.) $ Total cash flom Rate of return c. What is the cost of equity for St. Louis and St. Romuald? (Do not round intermediate calculations. Enter your answer as a percentage rounded to 2 decimal places.) Cost of equity St. Louis St. Romuald SIC

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts