Question: Help Save & Exit Submit The following transactions pertain to Smith Training Company for Year 1: January 30 Established the business when it acquired

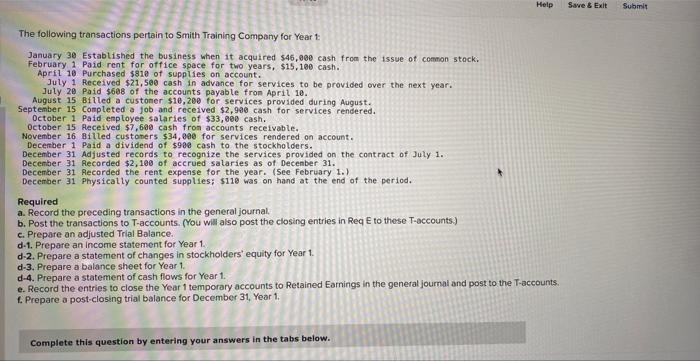

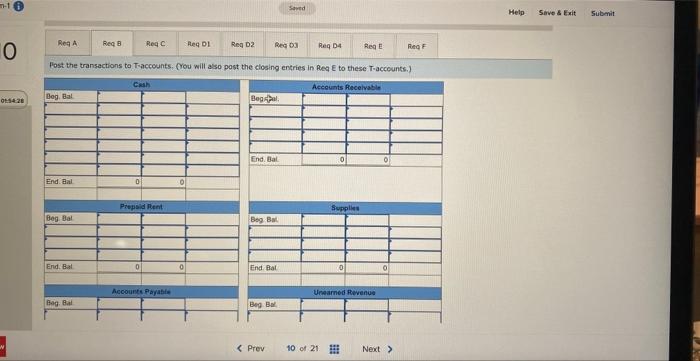

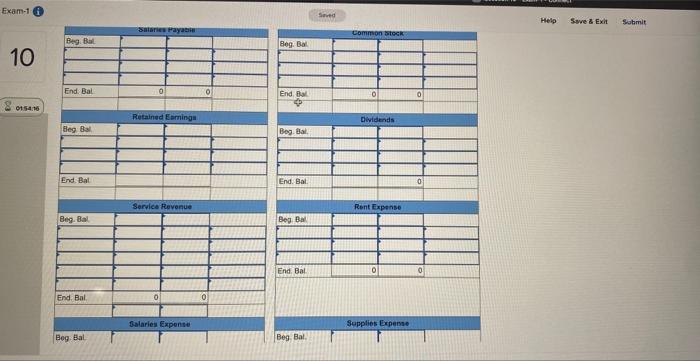

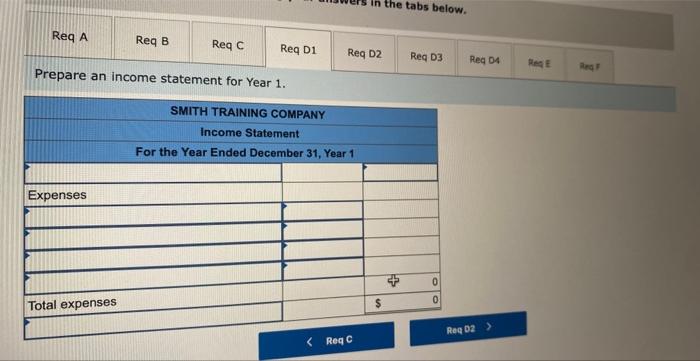

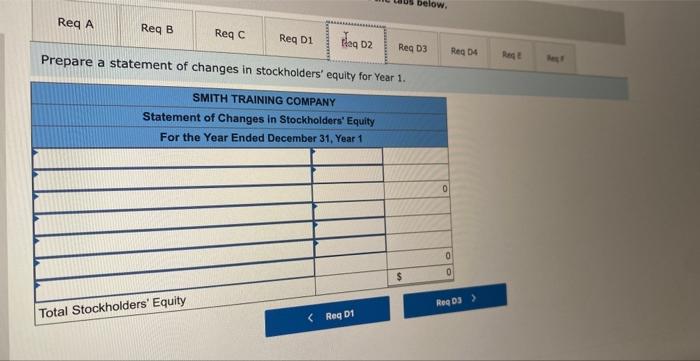

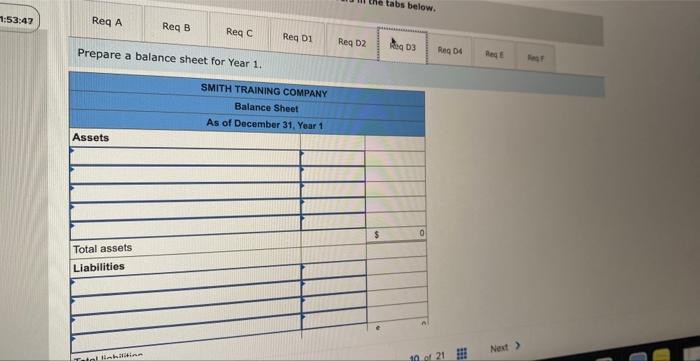

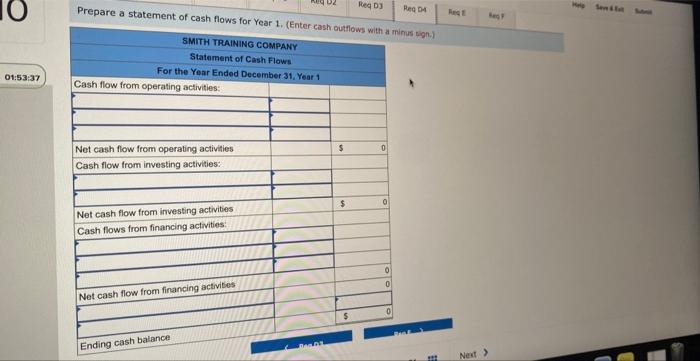

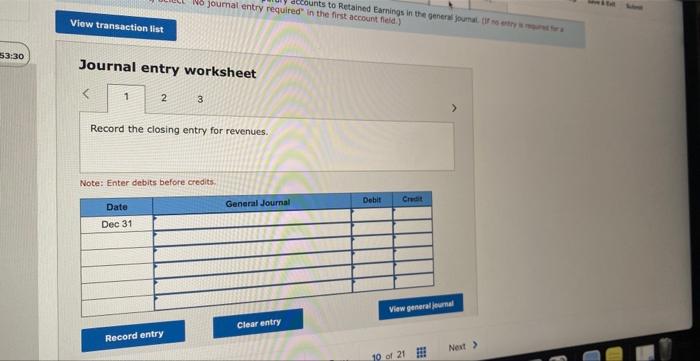

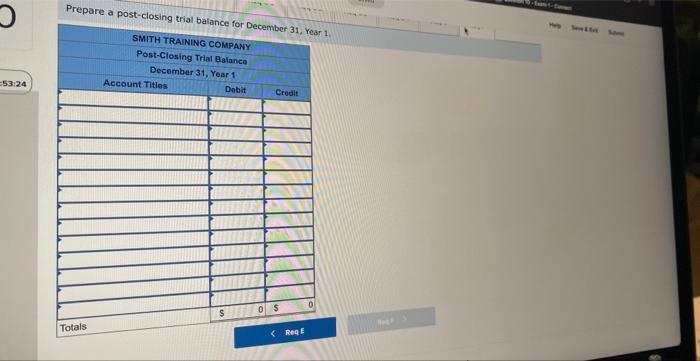

Help Save & Exit Submit The following transactions pertain to Smith Training Company for Year 1: January 30 Established the business when it acquired $46,000 cash from the issue of common stock. February 1 Paid rent for office space for two years, $15,100 cash. April 10 Purchased $810 of supplies on account. July 1 Received $21,500 cash in advance for services to be provided over the next year. July 20 Paid $688 of the accounts payable from April 10. August 15 Billed a customer $10,200 for services provided during August. September 15 Completed a job and received $2,900 cash for services rendered. October 1 Paid employee salaries of $33,000 cash. October 15 Received $7,600 cash from accounts receivable. November 16 Billed customers $34,000 for services rendered on account. December 1 Paid a dividend of $900 cash to the stockholders. December 31 Adjusted records to recognize the services provided on the contract of July 1. December 31 Recorded $2,100 of accrued salaries as of December 31. December 31 Recorded the rent expense for the year. (See February 1.) December 31 Physically counted supplies; $110 was on hand at the end of the period. Required a. Record the preceding transactions in the general journal. b. Post the transactions to T-accounts. (You will also post the closing entries in Req E to these T-accounts.) c. Prepare an adjusted Trial Balance.. d-1. Prepare an income statement for Year 1. d-2. Prepare a statement of changes in stockholders' equity for Year 1. d-3. Prepare a balance sheet for Year 1. d-4. Prepare a statement of cash flows for Year 1. e. Record the entries to close the Year 1 temporary accounts to Retained Earnings in the general journal and post to the T-accounts. f. Prepare a post-closing trial balance for December 31, Year 1. Complete this question by entering your answers in the tabs below.

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts