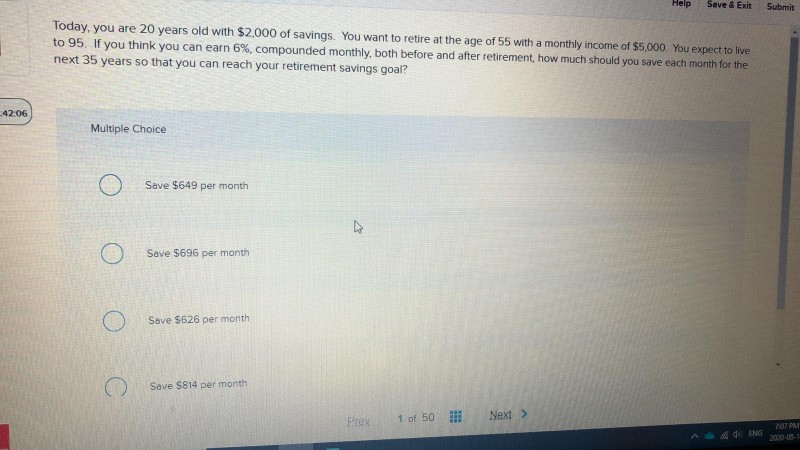

Question: Help Save & Exit Submit Today, you are 20 years old with $2,000 of savings. You want to retire at the age of 55 with

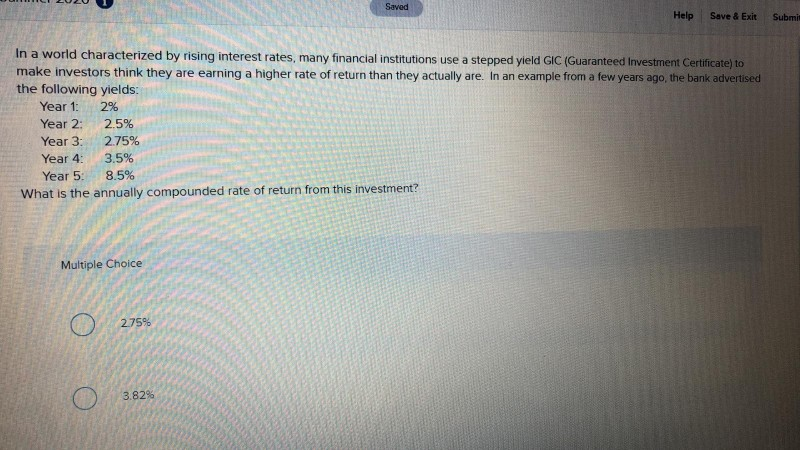

Help Save & Exit Submit Today, you are 20 years old with $2,000 of savings. You want to retire at the age of 55 with a monthly income of $5,000 You expect to live to 95. If you think you can earn 6%, compounded monthly, both before and after retirement, how much should you save each month for the next 35 years so that you can reach your retirement savings goal? 42:06 Multiple Choice Save $649 per month Save $696 per month Save $626 per month Save $814 per month Prex 1 of 50 !!! Next > 0 PM de ENG Saved Help Save & Exit Submit In a world characterized by rising interest rates, many financial institutions use a stepped yield GIC (Guaranteed Investment Certificate) to make investors think they are earning a higher rate of return than they actually are. In an example from a few years ago, the bank advertised the following yields: Year 1: 2% Year 2: 2.5% Year 3: 2.75% Year 4: 3.5% Year 5 8.5% What is the annually compounded rate of return from this investment? Multiple Choice 2.75% 3.829

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts