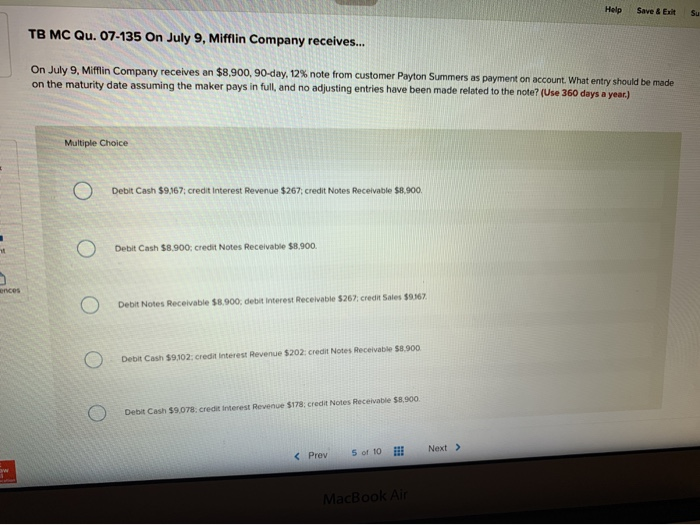

Question: Help Save & Exit TB MC Qu. 07-135 On July 9, Mifflin Company receives... On July 9. Mifflin Company receives an $8.900, 90-day, 12% note

Help Save & Exit TB MC Qu. 07-135 On July 9, Mifflin Company receives... On July 9. Mifflin Company receives an $8.900, 90-day, 12% note from customer Payton Summers as payment on account. What entry should be made on the maturity date assuming the maker pays in full, and no adjusting entries have been made related to the note? (Use 360 days a year.) Multiple Choice 0 Debit Cash $9.367, credit interest Revenue $267, credit Notes Receivable $8.900. 0 O Debit Cash $8.900: Credit Notes Receivable $8.900 0 Debit Notes Receivable $8.900debit interest Receivable 5267, cred Sales $9.367 0 Debit Cash $9.302: credit interest Revenue 5202 credit Notes Receivable 58.900 Debit Cash $9.078 credit interest Revenue $178 credit Notes Receivable $8.900 0

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts