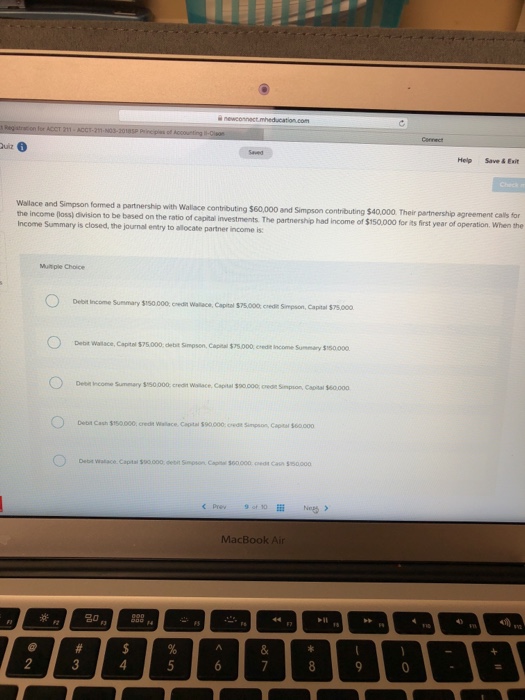

Question: Help Save & Exit Walace and Simpson formed a partnership with Wallace contributing $60,000 and Simpson contributing the income (oss) division to be based on

Help Save & Exit Walace and Simpson formed a partnership with Wallace contributing $60,000 and Simpson contributing the income (oss) division to be based on the ratio of capitai investments. The partnership Income Summary is closed, the journal entry to allocate partner income is $40.000 Their partnership agreement cals for had income of $150,000 for its first year of operation. When the Mumple Choice Debit Income Summary $150.000, ced ace,Capital $75,000. cedi Smpson, Capital Capital $75000, debt Smpson, Captal 75000 eredt income Summary 150000 De come Sumnary $50.000, credt Wsilace,Capital $00.000, ce impson, Capital 60,000 Debt Cash $150.000, credit Wislace Cpital $90.000 cede Simpson, Capital s60 000 Debe walace. Capital 500 000 ceb Simson Cap 00000 ed Casn $50000 MacBook Ai 0 4

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts