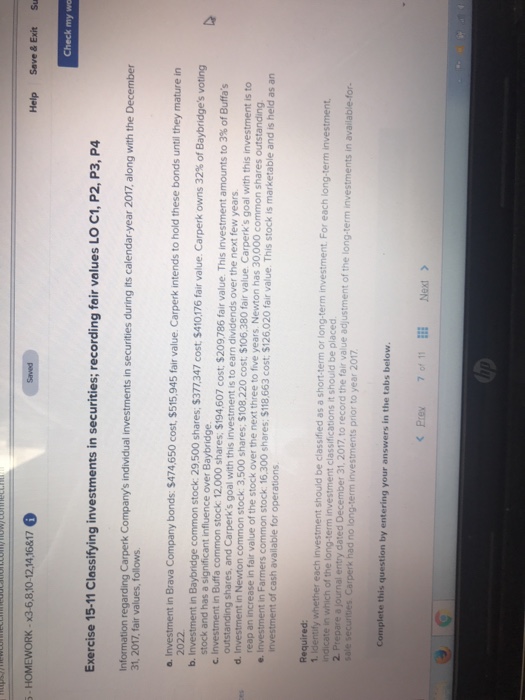

Question: Help Save & ExitSu 5- HOMEWORK -x3-6,810-12,14,16&17 Exercise 15-11 Classifying investments in securities; recording fair values LO C1, P2, P3, P4 Information regarding Carperk Company's

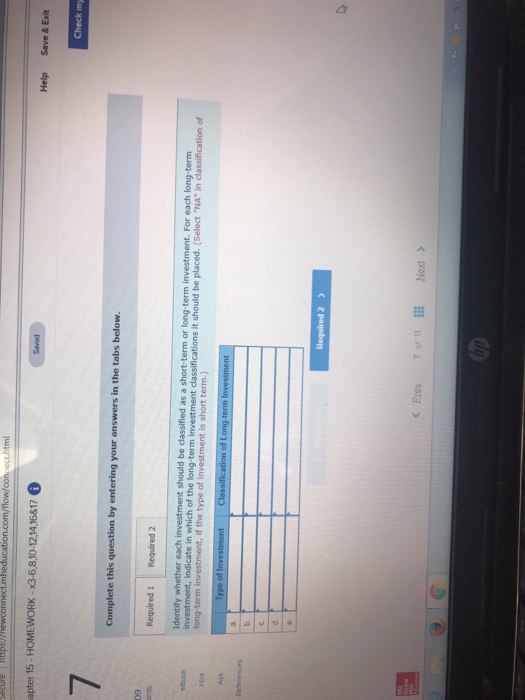

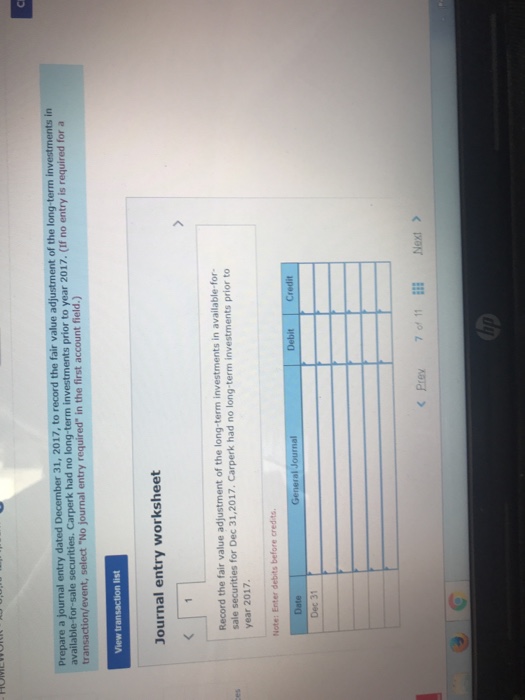

Help Save & ExitSu 5- HOMEWORK -x3-6,810-12,14,16&17 Exercise 15-11 Classifying investments in securities; recording fair values LO C1, P2, P3, P4 Information regarding Carperk Company's individual investments in securities during its calendar-year 2017, along with the December 31, 2017, fair values, follows o. Investment in Brava Company bonds: $474,650 cost, $515,945 fair value. Carperk intends to hold these bonds until they mature in 2022 b. Investment in Baybridge common stock, 29,500 shares; S377347 cost $410176 fair value. Carperk owns 32% of Baybridge's voting stock and has a significant influence over Baybridge. in Buffa common stock 12,000 shares $194607 cost $209,786 fair value. This investment amounts to 3% of Buffa's s goal with this investment is to earn dividends over the next few years ent in Newton common stock: 3,500 shares: $108.220 cost $106.380 fair value. Carperk's goal with this investment is to in fair value of the stock over the next three to five years. Newton has 30,000 common shares outstanding in Farmers reap an e. Investment in Farmers common stock: 16,300 shares; $118.663 cost, $126.020 fair value. This stock is marketable and investment of cash available for operations Required: tment should be classified as a short-term or long-term investment. For each long-term indicate in which of the long-term investment classifications it should be placed 2 Prepare a Journal entry dated December 31, 2017, to record the fair value adjustment of the long-term investments in avaia ents prior to year 2017 Complete this question by entering your answers in the tabs belovw Prex 70, 11 ??? Next >

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts