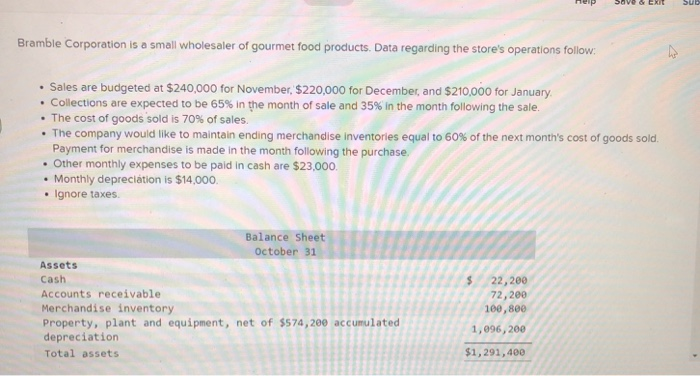

Question: Help Save & EXT Sub Bramble Corporation is a small wholesaler of gourmet food products. Data regarding the store's operations follow: Sales are budgeted at

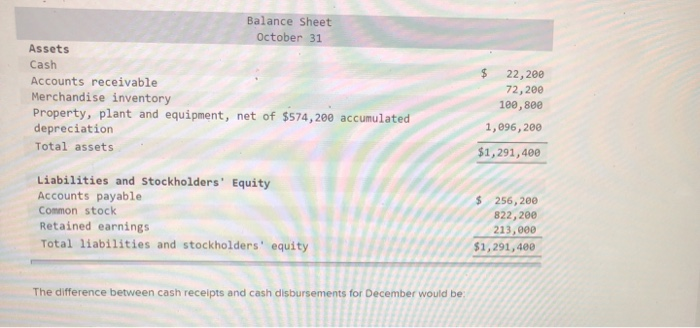

Help Save & EXT Sub Bramble Corporation is a small wholesaler of gourmet food products. Data regarding the store's operations follow: Sales are budgeted at $240,000 for November, $220,000 for December, and $210,000 for January Collections are expected to be 65% in the month of sale and 35% in the month following the sale. The cost of goods sold is 70% of sales. The company would like to maintain ending merchandise inventories equal to 60% of the next month's cost of goods sold. Payment for merchandise is made in the month following the purchase. Other monthly expenses to be paid in cash are $23,000. Monthly depreciation is $14,000 Ignore taxes Balance Sheet October 31 Assets Cash Accounts receivable Merchandise inventory Property, plant and equipment, net of $574,200 accumulated depreciation Total assets $ 22,200 72,200 100,800 1,096, 200 $1,291,400 $ Balance Sheet October 31 Assets Cash Accounts receivable Merchandise inventory Property, plant and equipment, net of $574,200 accumulated depreciation Total assets 22,200 72,200 188,888 1,096, 200 $1,291,400 Liabilities and Stockholders' Equity Accounts payable Common stock Retained earnings Total liabilities and stockholders' equity 256,200 822,200 213,000 $1,291,400 The difference between cash receipts and cash disbursements for December would be

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts