Question: Help Save & Ext Submi On January 1 Year, the City Taxi Company purchased a new taxicab for $57,000. The cab has an expected salvage

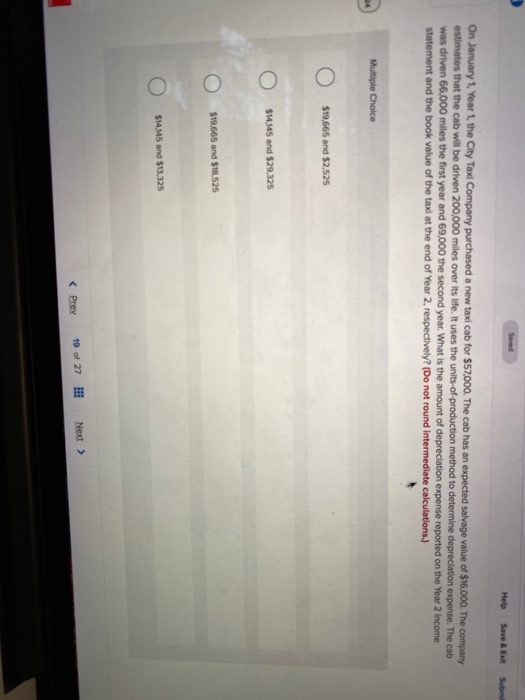

Help Save & Ext Submi On January 1 Year, the City Taxi Company purchased a new taxicab for $57,000. The cab has an expected salvage value of $16,000. The company estimates that the cab will be driven 200,000 miles over its life. It uses the units-of-production method to determine depreciation expense. The cab was driven 66,000 miles the first year and 69,000 the second year. What is the amount of depreciation expense reported on the Year 2 income statement and the book value of the taxi at the end of Year 2, respectively? (Do not round Intermediate calculations.) Multiple Choice $19,665 and $2,525 O $14,345 and $29,325 O $19,665 and $18,525 O $14,345 and $13,325

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts