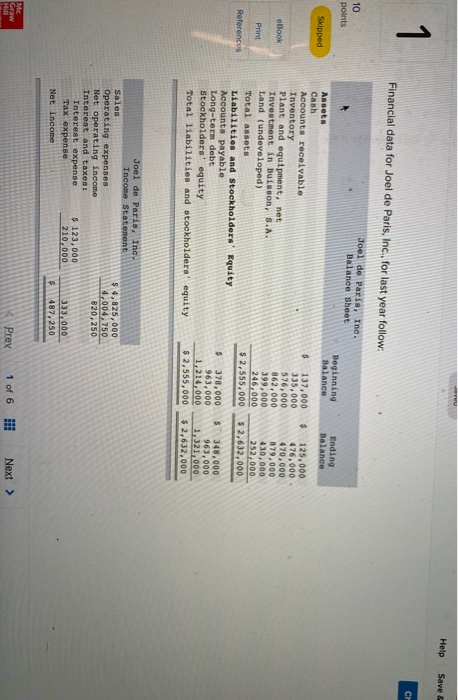

Question: Help Save Financial data for Joel de Paris, Inc., for last year follow. 10 Joel de Paris, Inc. Balance Sheet points Beginning Balance Ending Balance

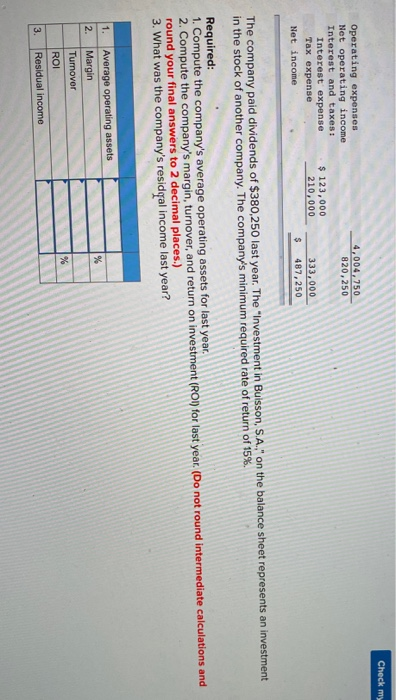

Help Save Financial data for Joel de Paris, Inc., for last year follow. 10 Joel de Paris, Inc. Balance Sheet points Beginning Balance Ending Balance Skipped Book Assets Cash Accounts receivable Inventory Plant and equipment, net Investment in Buisson, S.A. Land (undeveloped) Total assets Liabilities and Stockholders' Equity Accounts payable Long-term debt Stockholders' equity Total liabilities and stockholders' equity 137,000 J35,000 576,000 862,000 399,000 246,000 $ 2,555,000 $ 125,000 476,000 470,000 879,000 430,000 252,000 $2,632,000 References 378,000 963,000 1,214,000 $ 2,555,000 $ 348,000 963.000 1,321,000 $2,632,000 Joel de Paris, Ine. Income Statement Sales Operating expenses Net operating income Interest and taxes: Interest expense $ 123,000 Tax expense 210,000 Net income $ 4,825,000 1 ,004,250 820,250 333,000 487,250 Prev 1 of 6 Next > Check my 4,004,750 820,250 Operating expenses Net operating income Interest and taxes: Interest expense Tax expense Net income $ 123,000 210,000 333,000 407,250 The company paid dividends of $380,250 last year. The "Investment in Bulsson, S.A." on the balance sheet represents an investment in the stock of another company. The company's minimum required rate of return of 15%. Required: 1. Compute the company's average operating assets for last year. 2. Compute the company's margin, turnover, and return on investment (ROI) for last year. (Do not round Intermediate calculations and round your final answers to 2 decimal places.) 3. What was the company's residxal income last year? Average operating assets Margin Turnover ROI Residual income 3

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts