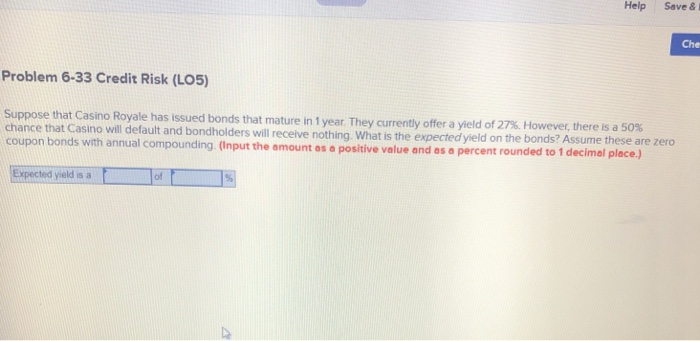

Question: Help Save &I Che Problem 6-33 Credit Risk (LO5) Suppose thatCasino Royale has issued bonds that mature in 1 year They currently offer a yield

Help Save &I Che Problem 6-33 Credit Risk (LO5) Suppose thatCasino Royale has issued bonds that mature in 1 year They currently offer a yield of 27%. However, there is a 50% chance that Casino will default and bondholders will receive nothing What is the expected yield on the bonds? Assume these are a coupon bonds with annual compounding (Input the amount as a positive value and as a percent rounded to 1 decimal place.) ted yield is a of

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts