Question: help Save o EXIT Submit Check my work 5 Required: Sheniqua, a single taxpayer, had taxable income of $77,724. Her employer withheld $12,644 in federal

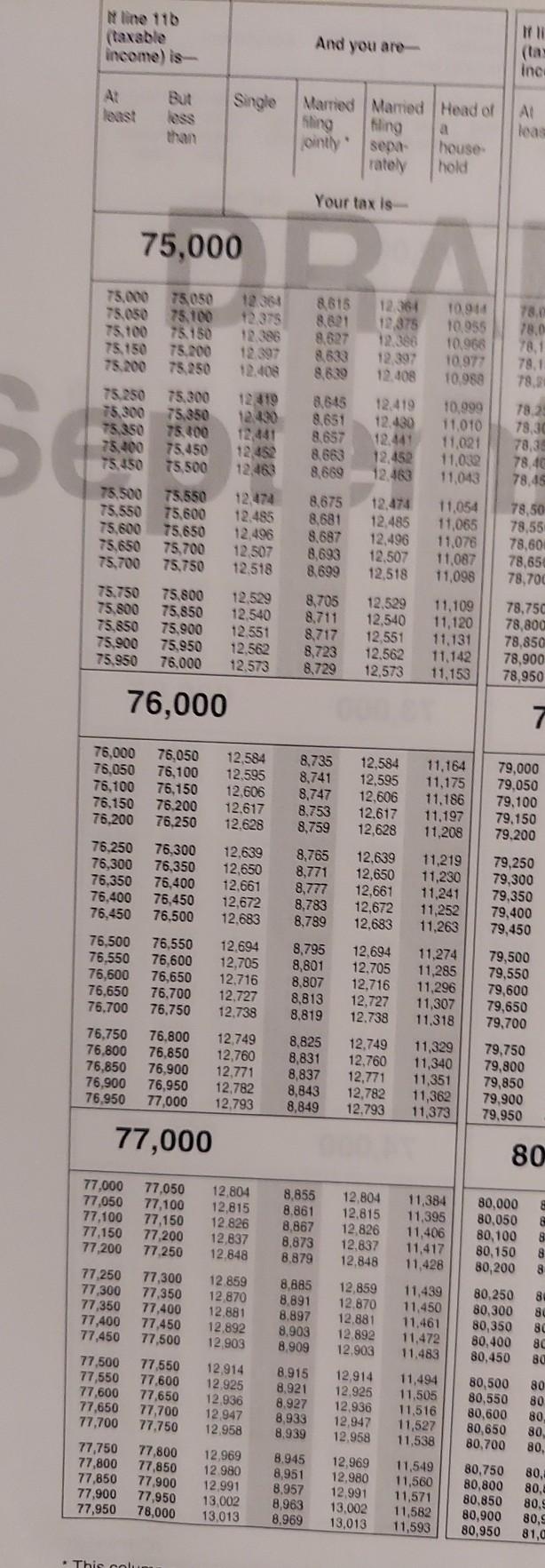

help Save o EXIT Submit Check my work 5 Required: Sheniqua, a single taxpayer, had taxable income of $77,724. Her employer withheld $12,644 in federal income tax from her paychecks throughout the year. What is the amount of refund would Sheniqua receive or additional tax she would pay? (Input your answer as a positive number.) 10 points Use the appropriate Tax Tables Skipped eBook Print Additional tax due References Amount of refund M line 116 (taxable income) is M And you are ind But Single least Married Married Head of Sling filing a jointly sepa house rately hold A leas than Your tax is 75,000 12.364 12.375 12.364 12,375 75050 75.100 75 150 T5.200 75,250 8815 8.821 8.627 8630 8630 75,000 75,050 75 100 75 150 78.200 75.250 75,300 75.350 75 400 75.450 10 9 10.955 10.968 10.97 10.989 12.397 78 78.0 78 78.1 78. 12,397 12.408 se 75.300 75,350 78 400 75.450 75.500 12819 12430 12441 78.2 78,30 8.645 8,651 8.657 8.663 8,689 12.419 12.430 12.441 12,452 12.463 10.999 11.010 11,021 11.032 11,043 78,33 12,463 78.48 78.45 12,474 78,50 75.500 75.550 75.600 75,650 75.700 12,474 12.485 12.496 12,507 12.518 8.675 8,681 8,687 12.485 75.550 75,600 75.650 75,700 75.750 75,800 75,850 75,900 75,950 76,000 8,693 11,054 11,065 11,076 11,087 11,098 12,496 12,507 12,518 78,58 78,60 78,65 78,700 8.699 75.750 75,800 75,850 75.900 75,950 12,529 12.540 12.551 12,562 12,573 8705 8.711 8.717 8,723 8.729 12,529 12,540 12,551 12.562 12,573 11.109 11,120 11.131 11.142 11,153 78,750 78,800 78,850 78.900 78,950 76,000 7 76,000 76.050 76,100 76,150 76,200 76,050 76,100 76,150 76.200 76,250 12,584 12,595 12.606 12.617 12.628 8,735 8,741 8.747 8,753 8,759 12,584 12.595 12,606 12.617 12,628 11.164 11,175 11.186 11.197 11.208 79,000 79,050 79.100 79.150 79.200 76.250 76,300 76.350 76,400 76,450 76,300 76,350 76,400 76,450 76.500 12.639 12,650 12.661 12,672 12.683 8,765 8,771 8,777 8,783 8.789 12.639 12,650 12,661 12,672 12,683 11,219 11,230 11.241 11,252 11,263 79,250 79,300 79.350 79.400 79,450 76,500 76,550 76,600 76.650 76.700 76.550 76,600 76,650 76.700 76,750 12.694 12,705 12.716 12.727 12.738 8,795 8,801 8,807 8,813 8.819 12,694 12.705 12.716 12,727 12.738 11.274 11,285 11,296 11.307 11.318 79,500 79,550 79,600 79,650 79,700 76,750 76,800 76,850 76.900 76,950 76.800 76,850 76.900 76,950 77,000 12,749 12,760 12.771 12.782 12,793 11.329 11,340 8.825 8,831 8,837 8,843 8,849 12.749 12,760 12,771 12,782 12,793 11,351 11,362 79.750 79,800 79,850 79,900 11,373 79.950 77,000 80 77,000 77,050 77,100 77.150 77,200 77,050 77,100 77,150 77,200 77.250 12,804 12,815 12.826 12,837 12,848 8,855 8.861 8,867 8.873 8.879 12,804 12.815 12,826 12,837 12,848 11,384 11,395 11,406 11,417 11,428 80,000 80,050 80,100 80,150 80,200 & 8 8 8 77,300 77,350 77,400 77,450 77,500 12.859 12,870 12.881 12,892 12.903 8,885 8.891 8,897 8,903 8,909 12,859 12,870 12.881 12.892 12.903 80,250 80,300 80,350 80,400 80,450 77,250 77.300 77,350 77,400 77,450 77,500 77,550 77,600 77,650 77,700 77,750 77,800 77,850 77,900 77,950 8 8 80 80 80 77,550 77,600 77,650 77,700 77,750 11,439 11,450 11,461 11,472 11.483 11,494 11.505 11,516 11,527 11,538 12,914 12,925 12.936 12 947 12.958 8.915 8,921 8.927 8,933 8,939 12,914 12.925 12,936 12,947 12.958 80,500 80,550 80,600 80,650 80,700 80 80 80 80 80, 12,969 77,800 77,850 77.900 77,950 78,000 12,969 12.980 12.991 13,002 13.013 8.945 8,951 8.957 8,963 8.969 12,980 12,991 13,002 13,013 11,549 11,560 11,571 11,582 11,593 80,750 80,800 80,850 80,900 80,950 80. 80, 80,9 80,9 81,0 This colum

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts