Question: Help Save Problem 14-12 Marking to Market (LO2, CFA2) You are long 22 gold futures contracts, established at an initial settle price of $1.518 per

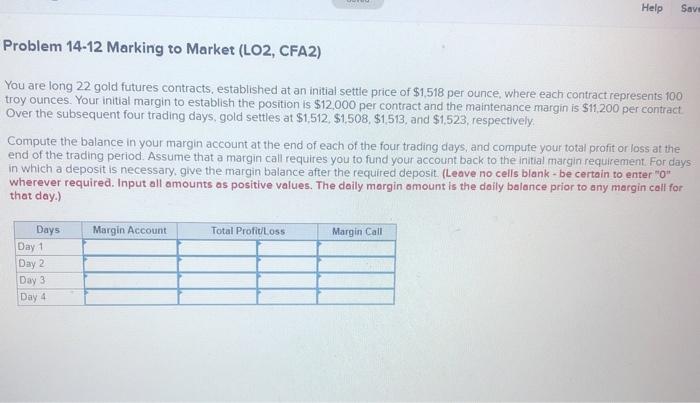

Help Save Problem 14-12 Marking to Market (LO2, CFA2) You are long 22 gold futures contracts, established at an initial settle price of $1.518 per ounce, where each contract represents 100 troy ounces. Your initial margin to establish the position is $12,000 per contract and the maintenance margin is $11,200 per contract Over the subsequent four trading days, gold settles at $1,512, $1.508, $1.513, and $1.523, respectively, Compute the balance in your margin account at the end of each of the four trading days, and compute your total profit or loss at the end of the trading period. Assume that a margin call requires you to fund your account back to the initial margin requirement. For days in which a deposit is necessary, give the margin balance after the required deposit. (Leave no cells blank - be certain to enter "O" wherever required. Input all amounts as positive values. The daily margin amount is the daily balance prior to any margin call for that day.) Margin Account Total ProfitLoss Margin Call Days Day 1 Day 2 Day 3 Day 4

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts