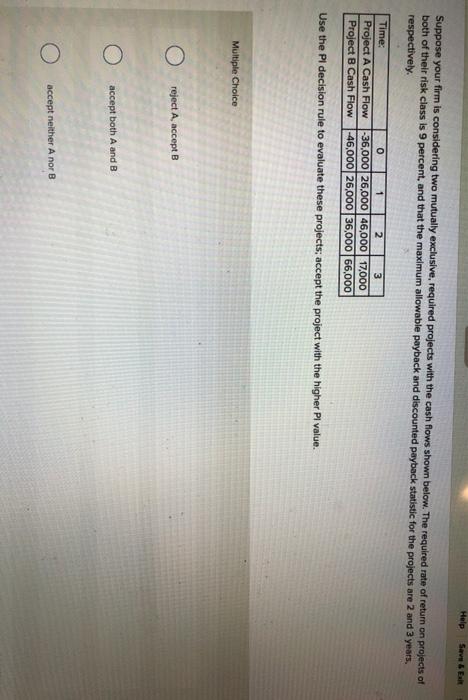

Question: Help Save SER Suppose your firm is considering two mutually exclusive, required projects with the cash flows shown below. The required rate of return on

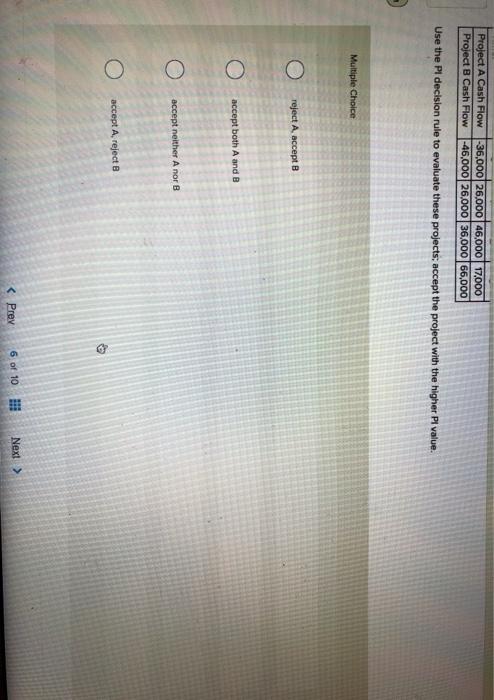

Help Save SER Suppose your firm is considering two mutually exclusive, required projects with the cash flows shown below. The required rate of return on projects of both of their risk class is 9 percent, and that the maximum allowable payback and discounted payback statistic for the projects are 2 and 3 years respectively. Time: Project A Cash Flow Project B Cash Flow O 1 2 3 -36,000 26,000 46,000 17.000 -46,000 26,000 36,000 66.000 Use the Pl decision rule to evaluate these projects; accept the project with the higher Pl value. Multiple Choice O reject A, accept B accept both A and B accept neither Anor B Project A Cash Flow Project B Cash Flow -36.000 26,000 46,000 17,000 -46.000 26.000 36,000 66,000 Use the Pl decision rule to evaluate these projects, accept the project with the higher Pl value. Multiple Choice reject A accept accept both A and B accept neither A nor B accept A rejecte 6

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts