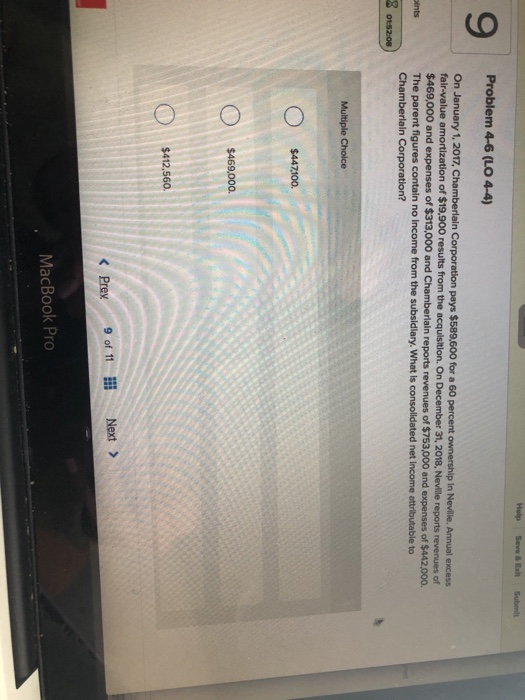

Question: Help Save & Submit Problem 4-6 (LO 4-4) On January 1, 2017, Chamberlain Corporation pays $589,600 for a 60 percent ownership in Neville. Annual excess

Help Save & Submit Problem 4-6 (LO 4-4) On January 1, 2017, Chamberlain Corporation pays $589,600 for a 60 percent ownership in Neville. Annual excess fair value amortization of $19,900 results from the acquisition. On December 31, 2018, Neville reports revenues of $469,000 and expenses of $313,000 and Chamberlain reports revenues of $753,000 and expenses of $442,000, The parent figures contain no Income from the subsidiary. What is consolidated net income attributable to Chamberlain Corporation? ints 3 01:52:08 Multiple Choice $447,100. O $469,000. O $412,560 MacBook Pro

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts