Question: Help Save & uit Submit A portfolio is composed of two stocks, A and B Stock A has a standard deviation of return of 29%,

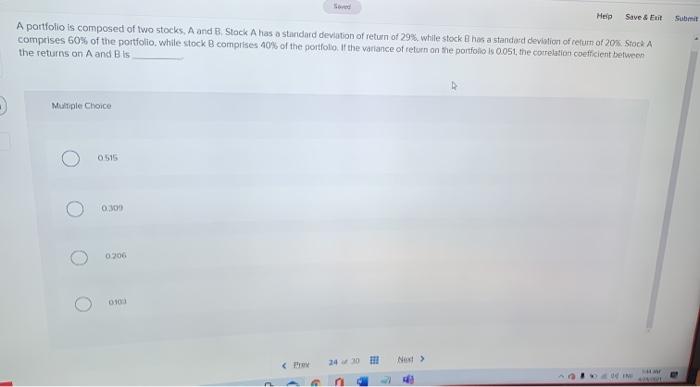

Help Save & uit Submit A portfolio is composed of two stocks, A and B Stock A has a standard deviation of return of 29%, while stock has a standard deviation of return of 20%. Stock comprises 60% of the portfolio, while stock B comprises 40% of the portfolio. If the vartance of return on the portfolio is 0.051, the correlation coefficient between the returns on A and B is Multiple Choice 0515 O 0.00 0906 000

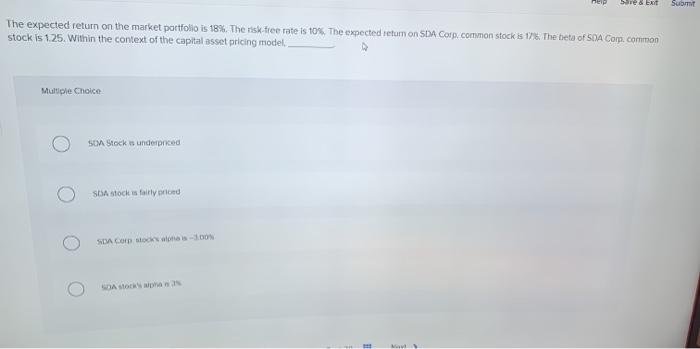

IN Sive & Ext Luont Submit The expected return on the market portfolio is 18%. The risk tree rate is 10%. The expected retum on SDA Corp. common stock is 17: The beta of SDA Corp. common stock is 125. Within the context of the capital asset pricing model Multiple Choice SA Stock is underpnced SDA stocks fairly priced SDA corn socis A phas

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts