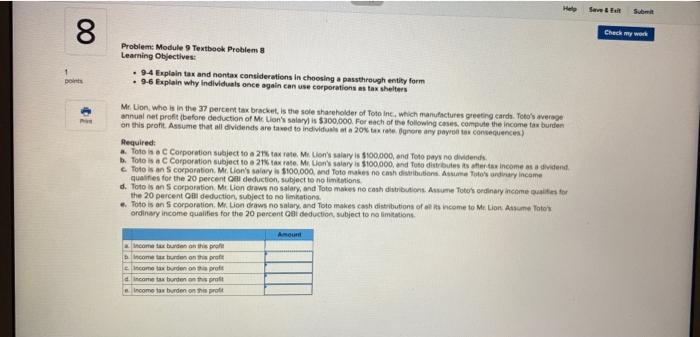

Question: Help See Submit 8 Check my work Probleme Module 9 Textbook Problem Learning Objectives: 9.4 Explain tax and nonta considerations in choosing a passthrough entity

Help See Submit 8 Check my work Probleme Module 9 Textbook Problem Learning Objectives: 9.4 Explain tax and nonta considerations in choosing a passthrough entity form . 9-6 Explain why individuals once again can use corporations as tax shelters 1 pois Mr. Lon who is in the 37 percent tax bracket is the sole shareholder of foto ine, which manufactures greeting cards Toto's were annual net profit (before deduction of Me Lion's salary is $300,000. For each of the following coses compute the income tax burden on this profit. Assume that all dividends are taxed to individuale a 20% texte unor any Dayro to contences) Required #foto is a Corporation subject to a 27% tax rate. Me Lion's salary is $100,000, and Toto pays ne dividends Tolosa Corporation subject to 21% tate Men's says $100.000 and Tuto distributes after tax income as a dividend. Toto is incorporation Me Lion's salary $100.000 and Toto makes no emshiributors Autoundinary income qualifies for the 20 percent o deduction, subject to no limitations d. Toto an corporation, Milion draws no salary, and Tote makes no cash distributions Assume Toto's ordinary income was for the 20 percent o deduction, subject to no limitations ..Toto is ons corporation. Mi Londrs no stay and Toomakes can distribution of an inte income to Me Lion Assume Foto's ordinary income qualifiers for the 20 percent i deduction subject to no limitations Amount Income tax burden on this prole Income tax burden on this proft Income tax burden on is proft Income tax burden on this proft Income tax burden on

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts