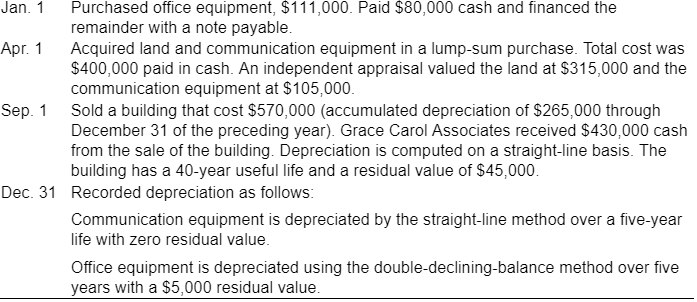

Question: help set up journal enteries for each one Jan. 1 Purchased office equipment, $111,000. Paid $80,000 cash and financed the remainder with a note payable

help set up journal enteries for each one

Jan. 1 Purchased office equipment, $111,000. Paid $80,000 cash and financed the remainder with a note payable Apr Acquired land and communication equipment in a lump-sum purchase. Total cost was $400,000 paid in cash. An independent appraisal valued the land at $315,000 and the communication equipment at $105,000 Sold a building that cost $570,000 (accumulated depreciation of $265,000 through December 31 of the preceding year). Grace Carol Associates received $430,000 cash from the sale of the building. Depreciation is computed on a straight-line basis. The building has a 40-year useful life and a residual value of $45,000 Recorded depreciation as follows: Communication equipment is depreciated by the straight-line method over a five-year life with zero residual value Sep. 1 Dec. 31 Office equipment is depreciated using the double-declining-balance method over five years with a $5,000 residual value

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts