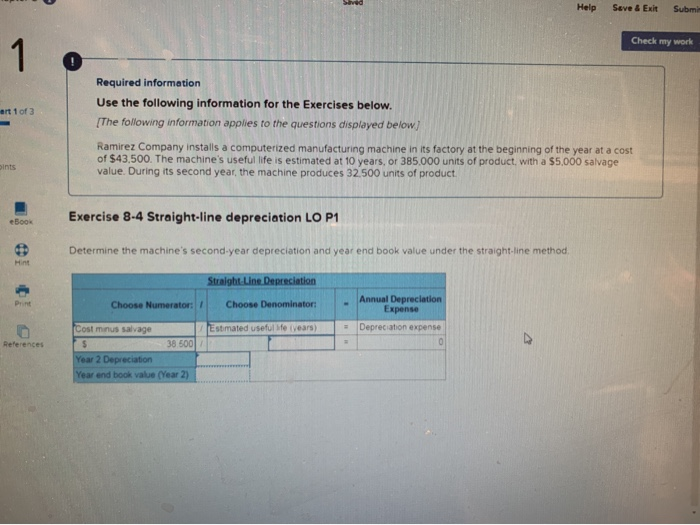

Question: Help Seve & Exit Submi Check my work 1 Required information Use the following information for the Exercises below. ert 1 of 3 [The following

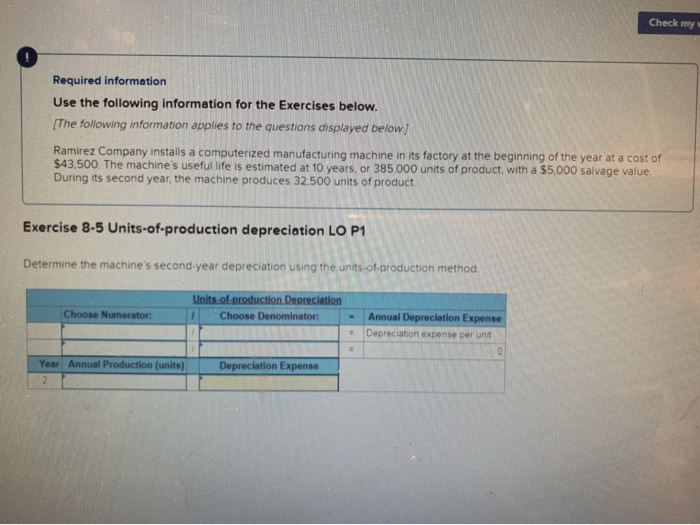

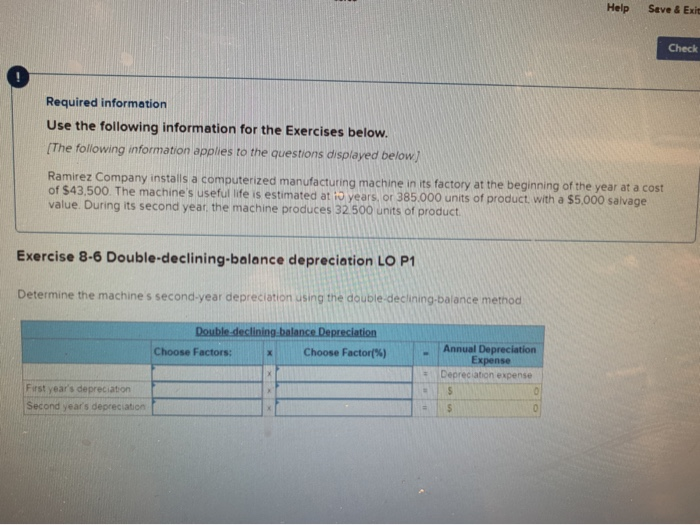

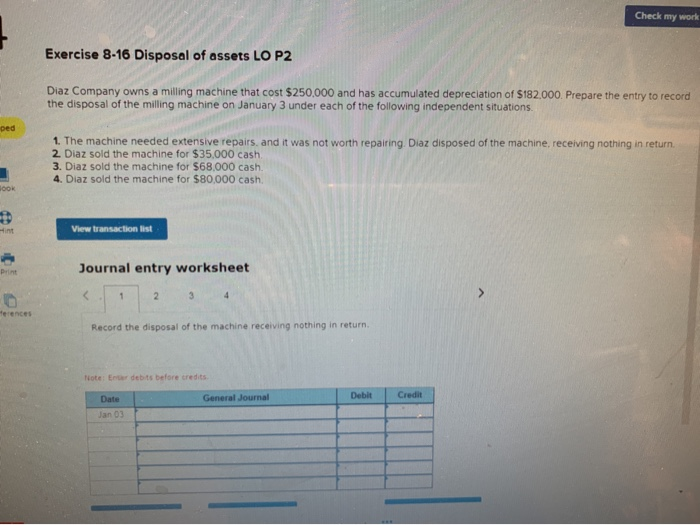

Help Seve & Exit Submi Check my work 1 Required information Use the following information for the Exercises below. ert 1 of 3 [The following information applies to the questions displayed below Ramirez Company installs a computerized manufacturing machine in its factory at the beginning of the year at a cost of $43,500. The machine's useful life is estimated at 10 years, or 385,000 units of product, with a $5,000 salvage value. During its second year, the machine produces 32.500 units of product pints Exercise 8-4 Straight-line depreciation LO P1 eB0ok Determine the machine's second-year depreciation and year end book value under the straight-line method Hint Straight Line Depreciation Annual Depreciation Expense Choose Denominator Print Choose Numerator: Estmated useful fe (ears) Depreciation expense Cost minus salvage 38 600 References Year 2 Depreciation Year end book value (Year 2) Check my Required information Use the following information for the Exercises below. [The following information applies to the questions displayed below Ramirez Company installs a computerized manufacturing machine in its factory at the beginning of the year at a cost of $43,500 The machine's useful life is estimated at 10 years, or 385.000 units of product, with a $5,000 salvage value During its second year, the machine produces 32.500 units of product Exercise 8-5 Units-of-production depreciation LO P1 Determine the machine's second-year depreciation using the units-of-production method Units of production Depreciation Choose Numerator Choose Denominator: Annual Depreciation Expense Depreciation expense per unit Year Annual Production (units) Depreciation Expense 2 Help Seve & Exit Check Required information Use the following information for the Exercises below. (The following information applies to the questions displayed below Ramirez Company installs a computerized manufacturing machine in its factory at the beginning of the year at a cost of $43,500 The machine's useful life is estimated at io years, or 385.000 units of product, with a $5,000 salvage value. During its second year, the machine produces 32 500 units of product Exercise 8-6 Double-declining-balance depreciation LO P1 Determine the machine s second-year depreciation using the double-declining-balance method Double-declining balance Depreciation Annual Depreciation Expense Choose Factor( %) Choose Factors: Depreciation expense S First year's depreciation Second years depreciation Check my work Exercise 8-16 Disposal of assets LO P2 Diaz Company the disposal of the milling machine on January 3 under each of the following independent situations. owns a milling machine that cost $250,000 and has accumulated depreciation of $182.000. Prepare the entry to record ped 1. The machine needed extensive repairs, and it was not worth repairing Diaz disposed of the machine, receiving nothing in return 2. Diaz sold the machine for $35,000 cash 3. Diaz sold the machine for $68,000 cash. 4, Diaz sold the machine for $80,000 cash ook Hint View transaction list Journal entry worksheet Print 2 3 C 1 ferences Record the disposal of the machine receiving nothing in return. Note: Entar debits before credits Credit Debit General Journal Date Jan 03

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts