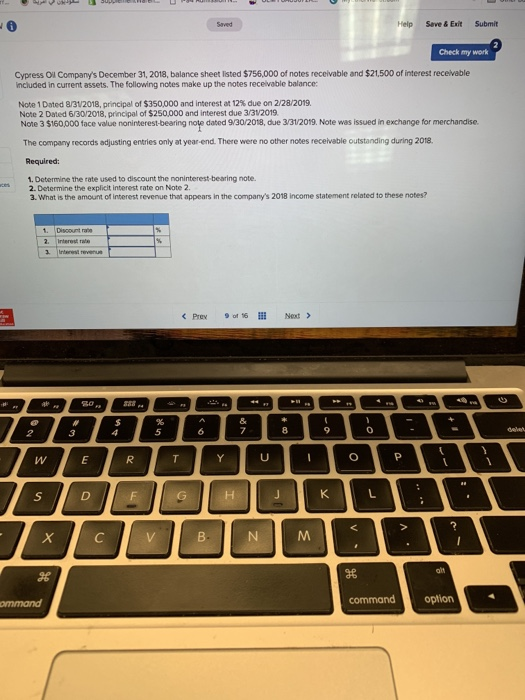

Question: Help Seve & Exit Submit Check my work Cypress Ol Company's December 31, 2018, balance sheet listed $756,000 of notes receivable and $21,500 of interest

Help Seve & Exit Submit Check my work Cypress Ol Company's December 31, 2018, balance sheet listed $756,000 of notes receivable and $21,500 of interest receivable included in current assets. The following notes make up the notes recelvable balance: Note 1 Dated a 312018, principal of $350,000 and interest at 12% due on 2/28/2019. Note 2 Dated 6/30/2018, principal of $250,000 and interest due 3/32019 Note 3 $160,000 face value noninterest bearing note dated 9/30/2018, due 3/31/2019. Note wes issued in exchange for merchandlise. The company records adjusting entries only at year-end. There were no other notes receivable outstanding during 2018. Required: 1. Determine the rate used to discount the noninterest-bearing note. 2.Determine the explicit interest rate on Note 2 3. What is the amount of interest revenue that appears in the company's 2018 income statement related to these notes? . Discount ro 20 5 commandoption

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts