Question: help slove this please. the last question as well. County Bank has $600,000 of 4% debenture bonds outstanding. The bonds were ad 102 in 2021

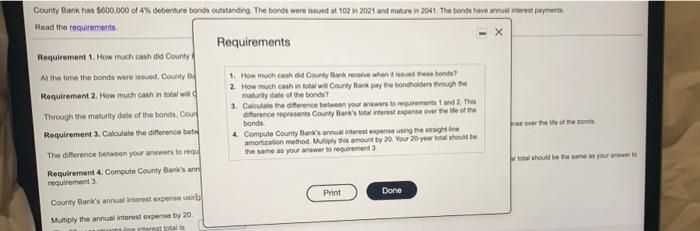

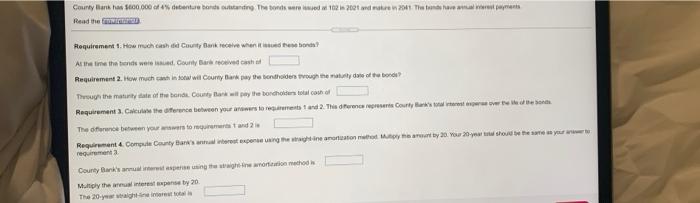

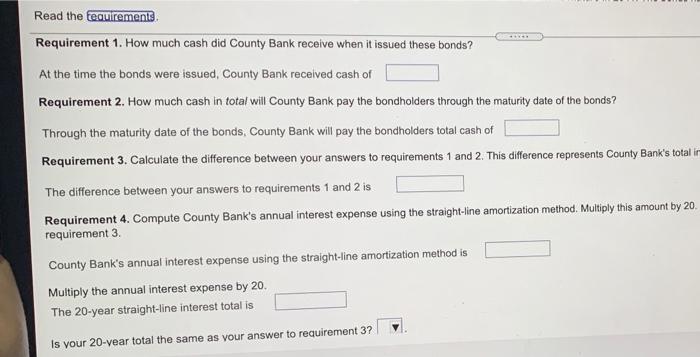

County Bank has $600,000 of 4% debenture bonds outstanding. The bonds were ad 102 in 2021 and nature in 2041 The bonds hovm annus vocest payment Read the requirements Requirements Requirement 1. How much cash did County At the time the bonds were issued, County 1. How much candid County Banches? 2. How much cash in totaal Courtyarpay the bondholds the Requirement 2. How much cash in total wild maturity Gate of the bonds? 1. Calculate the difference between you arewers to requirements and 2: The Through the maturity date of the bonds, Cour difference represents County Bank's response over the bonds Requirement 3. Calculate the difference bet over the of bones 4. Compute County Bank's annual trest expensessing the right in amortization method. Mis amount by 20. Your 20 year olshould be The difference between your awers to regu the same as your answer to quirement Requirement 4. Compute County Bank's ann requirement Print Done County Bank's annual interest expensil Multiply the annual interest expense by 20 totas County Bank has 600.000 franture banda uttanding. The bonds were 1622 de 2011. Tieten Read the Requirement. How much cash County Bank receive when the All the time the band wereld County Bareve cash Requirement 2. How much cash now wilCoury Burkay tendens tydende Through the maturitate of the bonde Counter wil my the border totalcohol Requirement. Cette er tween you and to rest and 2. This decer Courtyar The ofference between you were to gurutand Requirement. Comple County Banks interest expense ang hamonitory 20. Your 20 year show them your requirement County Bank's apare in the wrote methods Multiply the wintersponse by 20 The 20-year ago Read the requirements Requirement 1. How much cash did County Bank receive when it issued these bonds? At the time the bonds were issued, County Bank received cash of Requirement 2. How much cash in total will County Bank pay the bondholders through the maturity date of the bonds? Through the maturity date of the bonds, County Bank will pay the bondholders total cash of Requirement 3. Calculate the difference between your answers to requirements 1 and 2. This difference represents County Bank's total ir The difference between your answers to requirements 1 and 2 is Requirement 4. Compute County Bank's annual interest expense using the straight-line amortization method. Multiply this amount by 20. requirement 3. County Bank's annual interest expense using the straight-line amortization method is Multiply the annual interest expense by 20. The 20-year straight-line interest total is Is your 20-vear total the same as your answer to requirement 3

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts